Case Study : R&D Tax Credit

Dive into our diverse array of R&D tax credit case studies at Engineered Tax Services. Our mission is to empower businesses in various sectors by unlocking the full potential of R&D tax credits. Our seasoned team of professionals leverages their deep understanding of industry-specific expenses, qualifying activities and labor requirements to ensure our clients reap the maximum benefits from these tax incentives.

Our case studies serve as a testament to the transformative power of R&D tax credits across a wide range of industries. We’ve had the privilege of assisting a multitude of businesses, from engineering firms and manufacturing companies to software developers and architectural firms, in achieving substantial tax savings.

If you’re a business owner, a tax professional or someone interested in the intricacies of R&D tax credits, our case studies offer a wealth of information. Each one provides an in-depth analysis of how R&D tax credits have been successfully implemented in a specific business context, offering a clear picture of the potential tax savings.

R&D Case Study on an Engineering Firm in New York

1 Year Tax Savings: $1,175,120.00 Engineered Tax Services worked to uncover $19,887,332 in qualified research expenses for this engineering firm

R&D Case Study on an Engineering Firm in California

1 Year Tax Savings: $516,627.00 This engineering firm in California participated in innovative development, making them eligible for research and

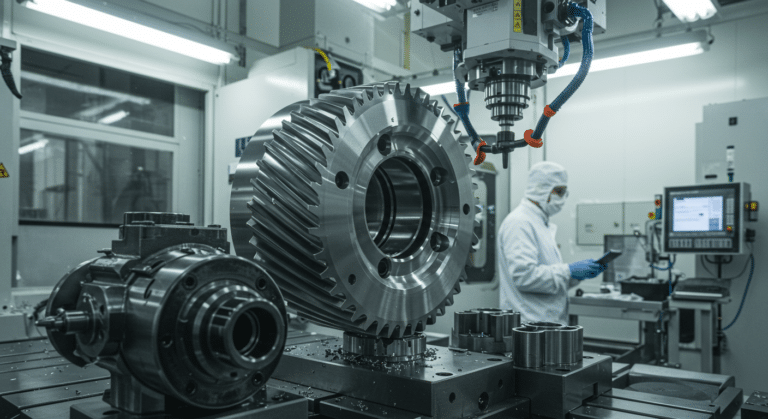

R&D Case Study on a Custom Manufacturer in New York

1 Year Tax Savings: $689,289.00 Engineered Tax Services helped this custom manufacturer in New York claim research and development tax

R&D Tax Credit Case Study For A Manufacturer/Machine Shop in Florida

4 Year Tax Savings: $393,098 (Federal Only) Engineered Tax Services conducted an R&D tax credit evaluation to help this machine

R&D Tax Credit Case Study for Software Developer in California

3 Year Tax Savings: $690,751 (Federal and State) By commissioning a research and development tax credit study, stakeholders for this

R&D Tax Credit Case Study for Civil Engineering and Architecture Firm in Georgia

1 Year Tax Savings: $541,379 (Federal and State) Study Highlights Wages $2,236,345 Total Qualified Research Expenditures $2,236,345 Get A Free