IRS Compliant

Engineering-Based

100% Secure

Cost Segregation

Services

Maximize your property's tax benefits with our expert cost segregation studies. Our engineering-based approach helps accelerate depreciation and increase cash flow.

Cost Segregation Services help businesses and property owners to accelerate tax deductions and increase cash flow.

Use our calculator to start a cost seg study analysis and consultation today!

250,000+

10x

Average return on investment

4-6 weeks

Specialized Cost Segregation Studies by Property Type

Maximize depreciation on office buildings, retail centers, warehouses, hotels, and medical facilities. Our studies typically identify 35% of components for acceleration.

- Average savings: $250,000+

- 35% of components accelerated

- ROI in under 12 months

- Average savings: $150,000+

- 30% of components accelerated

- 4-week study completion

Providing Cost Segregation

Studies Nationwide for 25 Years.

For 25 years, our cost segregation studies have helped clients unlock significant tax savings by accelerating depreciation and improving cash flow. By identifying assets others overlook, we reduce current tax liability and put more capital back into our clients’ businesses across all 50 states.

What is Cost Segregation?

Cost Segregation is a strategic approach to accelerate depreciation and enhance your property's tax benefits through engineering analysis. We do this by analyzing the costs of a commercial or income-producing property and putting them into specific asset categories.

In traditional methods, an entire commercial building or income-producing property would be treated as one individual long-term asset that depreciates over several years. Commercial buildings depreciate over 39 years and other income-producing properties, 27.5.

A Cost Segregation Study identifies separate components that have the ability to be depreciated within much shorter time frames. Typically, these components can be depreciated at 5, 7, or 15 years.

5-15yr

100%

20x

Strategic Tax Planning

Cost segregation is a strategic federal income tax tool that enhances near-term cash flow by accelerating depreciation deductions and deferring taxes. By identifying and reclassifying building components, property owners can maximize tax savings in the early years of ownership, often achieving $50,000 to $1M+ in first-year tax savings.

Accelerated Depreciation

Reduce from 27.5 or 39 years to 5, 7, or 15 years

Bonus Depreciation

40% bonus available in 2025 for qualified components

Engineering Analysis

Cash Flow Benefits

Property Reclassification Table

Check out your property type below to see how much depreciation can be accelerated for your investment property utilizing Cost Segregation services!

| Property Type | Depreciation Acceleration |

|---|---|

| Apartment Building | 20-40% |

| Assisted Living Facility | 22-45% |

| Auto-Car Dealership | 29-35% |

| Bank | 30-45% |

| Car Washes | 75-100% |

| Gas Stations | 50-100% |

| Conference Center | 25-35% |

| Fitness Center | 22-45% |

| Golf Course | 28-60% |

| Grocery Store | 20-45% |

| Hospital | 25-45% |

| Leasehold Improvements | 20-40% |

| Manufacturing | 18-40% |

| Medical Office/Clinic | 20-40% |

| Mixed Use | 22-35% |

| Mobile Home Parks | 20-40% |

| Office Building | 20-40% |

| Research Facility | 20-30% |

| Hotel & Resorts | 22-45% |

| Restaurant | 25-45% |

| Retail Strip Mall | 20-40% |

| Self Storage Facilities | 18-90% |

| Theme Park | 30-68% |

| Vacation Rentals | 25-45% |

| Warehouse | 20-30% |

Beyond Cost Segregation: Your Complete Tax Strategy Partner

ETS delivers a comprehensive suite of services designed to maximize your real estate investment returns. From innovative virtual engineering solutions to tailored insurance protection, we're your single source for integrated tax and risk management strategies.

Engineered Insurance Services

As an added bonus to your Cost Seg study with us, you'll also gain access to Engineered Insurance Services. We offer streamlined insurance solutions tailored specifically for real estate investors, all under one roof, saving you time and effort.

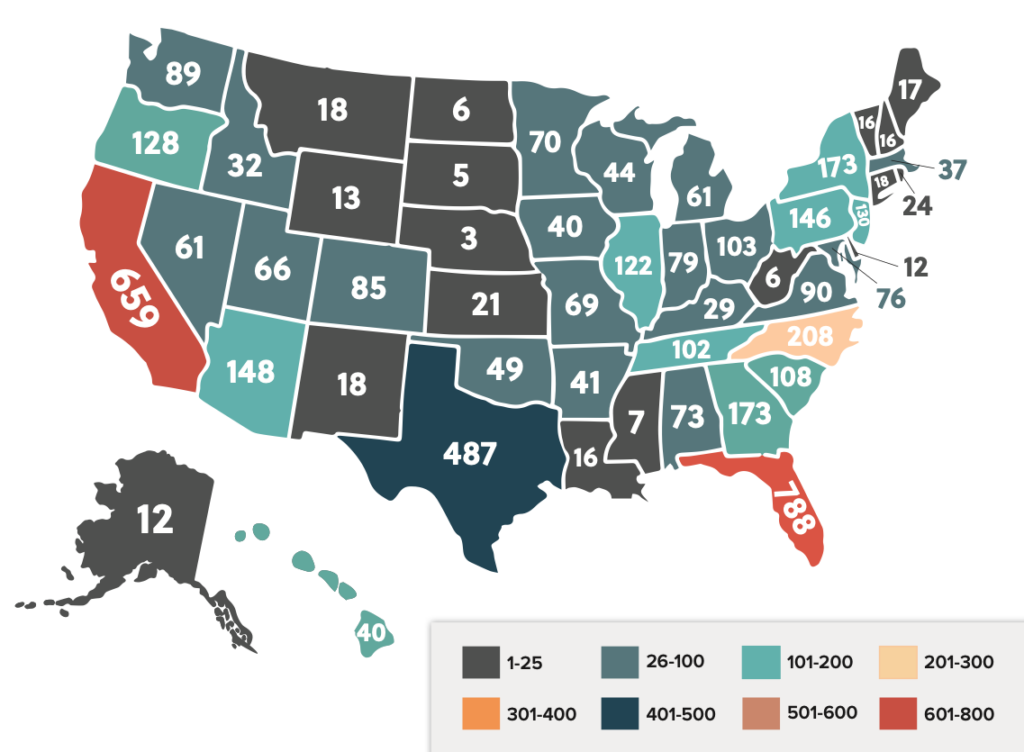

We Serve Clients Nationwide

Connect with your nearest ETS cost segregation specialist today to maximize your tax savings.

Find Your Nearest Office

Engineering-Based

Cost Segregation

Methodology

Our rigorous, data-driven approach ensures maximum tax benefits through detailed analysis

Engineering Analysis

- 1-2 weeks

- •

Our engineers conduct a thorough analysis of your property's components, systems, and construction documents.

Key Benefits:

- Detailed component identification

- Comprehensive documentation

- Professional engineering expertise

- IRS compliance assurance

- Site inspection and documentation

- Component identification and classification

- Engineering measurements and calculations

- Construction document review

- Detailed component inventory

- Engineering analysis report

- Photo documentation

- Construction document annotations

Cost Allocation

- 2-3 weeks

- •

Key Benefits:

- Accurate cost breakdowns

- Market-based valuations

- Detailed asset categorization

- Maximum tax benefit identification

- Cost data analysis

- Market value research

- Component cost allocation

- Value engineering review

- Cost allocation report

- Market value comparisons

- Asset categorization matrix

- Value optimization summary

Tax Classification

- 1-2 weeks

- •

Key Benefits:

- Proper asset classification

- Optimized depreciation schedules

- Regulatory compliance

- Enhanced tax savings

- IRS guideline review

- Recovery period assignment

- Depreciation calculation

- Compliance verification

- Tax classification report

- Depreciation schedules

- Compliance documentation

- Tax savings analysis

Documentation & Review

- 1 week

- •

Key Benefits:

- Detailed engineering reports

- IRS-compliant documentation

- Expert tax review

- Audit support materials

- Report compilation

- Expert review process

- Quality assurance checks

- Final documentation preparation

- Final engineering report

- Tax documentation package

- Audit support materials

- Implementation guidelines

Results & Strategic Planning

- 1-2 weeks

- •

Review the comprehensive benefits and strategic implications of your cost seg study for informed decision-making.

Key Benefits:

- Clear understanding of tax savings

- Strategic tax planning insights

- ROI analysis and projections

- Future planning recommendations

- Savings calculation review

- Strategic planning consultation

- Implementation timeline development

- Ongoing support coordination

- Executive summary report

- Tax savings projections

- Implementation roadmap

- Strategic recommendations

Ready to Maximize Your Property's Tax Benefits?

Commonly Missed Opportunities

Don't overlook these valuable components in your cost segregation study

Electrical Systems

- Task Lighting

- Security Systems

- Emergency Power Systems

- Specialized Equipment Wiring

- Building Management Systems

- Data Center Infrastructure

- LED Lighting Upgrades

HVAC Components

- Supplemental HVAC Units

- Process Cooling Systems

- Specialized Ventilation

- Temperature Control Systems

- Clean Room Systems

- Energy Recovery Units

- Smart Building Controls

Interior Improvements

- Decorative Finishes

- Removable Partitions

- Special Floor Coverings

- Custom Millwork

- Acoustic Treatments

- Specialty Lighting Fixtures

- Modular Office Systems

Site Improvements

- Landscaping Features

- Parking Lot Lighting

- Security Fencing

- Irrigation Systems

- Outdoor Signage

- Loading Dock Equipment

- Site Utilities

Specialty Systems

- Fire Suppression Equipment

- Access Control Systems

- Audio/Visual Systems

- Telecommunications

- Clean Room Infrastructure

- Laboratory Equipment

- Medical Gas Systems

Building Envelope

- Window Treatments

- Decorative Facades

- Entrance Systems

- Specialty Doors

- Solar Shading Devices

- Green Roof Systems

- Building Wraps

Educational Videos

The Ultimate Tax Saving Strategy

Invest Smarter: How Deferred and ETS Are Simplifying the 1031...

Tax Plan IQ Power Hour - Cost Segregation

Apr 2025

Bonus Depreciation Is Back at 100%

Bonus depreciation has been fully restored! This creates one of the most powerful tax opportunities available to real estate investors and business owners.

You can once again deduct 100% of the cost of qualifying property in the same year it’s placed in service. That means faster write-offs, stronger cash flow, and more capital to reinvest into your business.

What It Means for You

Non-structural interior improvements

Furniture, fixtures, and equipment (FF&E)

Land improvements such as parking lots and landscaping

Why it Matters

This restoration lets investors accelerate depreciation and fully deduct qualifying assets, creating immediate tax savings and cash for reinvestment.

Timing is Key

100% bonus depreciation applies to property acquired after January 19, 2025, and placed in service before 2030. Now the ideal time to act during this five-year window.

Real Results, Real Impact

Cost Segregation Analysis for a Mixed-Use Commercial/Residential Property in Selma, Texas

Selma, Texas

$3.639.910,89

$36.399.108,9

View Case Study →

Cost Segregation Analysis for a Medical-Dental Office in Cheyenne, Wyoming

Cheyenne, Wyoming

First Year Savings

$127.217,78

Property Value

$1.272.177,8

View Case Study →

Cost Segregation Analysis for a Hotel & Resort in Miami, Florida

Miami, Florida

First Year Savings

$1.678.500,45

$16.785.004,5

View Case Study →

500+

$2B+

98%

Frequently Asked Questions

What is included in a cost segregation study?

A cost segregation study surveys your building's subcomponents, like lighting fixtures, heating and air conditioning systems, and other components that deteriorate over time. It assigns five- or 15-year lifespans to these subcomponents. Then the study assesses how much in taxes you can write off because of your financial loss from these aging subcomponents.

How much should a cost segregation study cost?

It should cost between $3,000-$12,000. However, the capital outlay is more than worth it, considering you can save hundreds of thousands, if not millions, in taxes by commissioning a study. The ROI is amazing.

What is the best time of the year to do a cost segregation study?

Anytime. As long as you commission your cost seg study before a construction rehab. Because cost segregation sets a baseline for the original purchase, it's easier for us and the IRS to set that baseline by performing the study before the rehab, with an engineer documenting the reclassification, before the improvements are made.

Are cost segregation studies worth it?

Definitely! The 2025 One Big Beautiful Bill Act allows for an immediate deduction for the full costs in the first year. If you own a property with a class life of 27 years, you might be eligible for a sizeable bonus depreciation in year one by reallocating some of your building's assets to a five- or 15-year lifespan.

What types of properties qualify for cost segregation?

Most commercial and investment properties qualify, including office buildings, retail spaces, industrial facilities, apartments, hotels, medical facilities, and warehouses. Properties must have been built, purchased, or substantially renovated after 1986 to qualify.

How long does a cost segregation study take?

The typical timeline is 4-6 weeks from start to finish. This includes the initial property inspection, engineering analysis, and final report preparation. Larger or more complex properties may require additional time.

Can I do a cost segregation study on a property I've owned for several years?

Yes, through a 'look-back' study. You can claim missed depreciation from prior years without amending tax returns by filing Form 3115. This allows you to take advantage of accelerated depreciation even on properties owned for several years.

What documentation is needed for a cost segregation study?

Typically, we need property purchase documents, construction drawings if available, depreciation schedules, and renovation records. However, our engineering-based cost segregation approach can still deliver results even with limited documentation.

How does bonus depreciation affect cost segregation benefits?

Bonus depreciation allows for immediate expensing of qualified property. Through 2023, 80% bonus depreciation is available, phasing down to 60% in 2024, 40% in 2025, and 20% in 2026. This significantly enhances the benefits of cost segregation studies.

Will a cost seg study trigger an IRS audit?

No, a properly conducted cost segregation study should not trigger an audit. Our engineering-based approach follows IRS guidelines and provides thorough documentation to support all classifications and calculations in case of an audit.

What Our Clients Say

"ETS team has a strong referral base, and as a newbie to cost segregation the team was very helpful and informative! Namely, David helped walk the ropes with me and break down the full benefit of this amazing strategy. After speaking with a few professionals in the space, I am confident that they will take great care of me"

Connor Chanter

2025-11-05

⭐⭐⭐⭐⭐

"I’ve been with Engineered Tax Services for a while now as Director of Client Services, and I genuinely love what I do. It’s amazing to work for a company that’s truly focused on helping clients save money through smart, legal tax strategies—especially in real estate and business development. The team here is knowledgeable, supportive, and always willing to go the extra mile. It feels great to be part of a company that not only delivers real results for clients but also values its employees. I’m proud to be part of ETS and excited about the work we’re doing every day."

Julienna Viegas-Haws

2025-06-25

⭐⭐⭐⭐⭐

"I'm so happy I just learned about the advantages of cost segregation! With the help of an experienced advisor, I was able to determine which parts of my business property were eligible for accelerated depreciation, which led to considerable tax savings. The analysis was thorough and simple to comprehend, and the procedure was simple. I'm already excited to see how this strategy will work out in the long run."

Nadine Arnold

2025-07-21

⭐⭐⭐⭐⭐