Unlocking Opportunity: Real Estate Developer Incentives in Florida

Florida continues to be one of the most attractive states for real estate development, offering a powerful combination of pro-growth

Posts and full-length articles in this category will be covering specialty tax topics in relation to the Real Estate Industry. From tax strategies to tax deductions and credits, discover Real Estate-Focused tax topics here today.

Florida continues to be one of the most attractive states for real estate development, offering a powerful combination of pro-growth

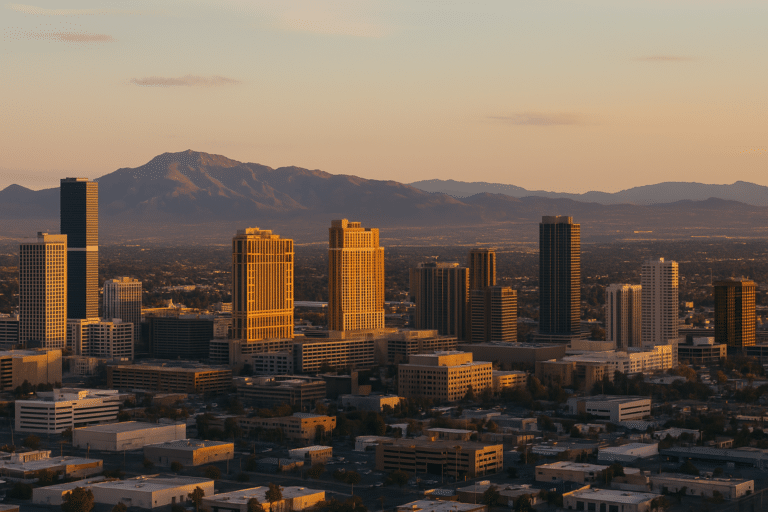

Nevada has firmly established itself as one of America’s most developer-friendly states, offering a strategic mix of tax incentives, regulatory

Are You Paying More for Less? The Alarming Reality of Insurance Shrinkflation In today’s challenging insurance market, multifamily property owners

If you’ve ever sold an investment property, you know how quickly capital gains taxes can eat into your profits. After

Maximizing Tax Benefits for Real Estate Professionals Investing in real estate can be highly rewarding, offering opportunities for long-term appreciation

Artificial Intelligence (AI) is revolutionizing industries worldwide, and real estate investing is no exception. While AI is streamlining property management

Tax planning is essential for all real estate investors, no matter how large or small your portfolio may be. Taxes

Navigating the complex world of commercial real estate requires grasping both market trends and the intricate, constantly changing tax laws

The preservation of historic buildings plays a vital role in maintaining the architectural and cultural heritage of our communities. To

The IRS recently released a fact sheet regarding two beneficial tax incentives for eco-conscious homeowners. If you’ve been thinking of

Find services, resources, case studies, and more

Esc to close