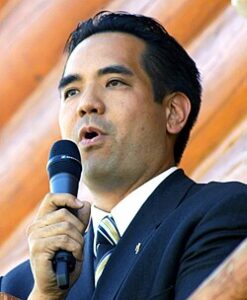

What an honor! Last week, our founder and CEO, Julio Gonzalez, was named as one of Florida’s top 50 Hispanic business leaders by the Florida State Hispanic Chamber of Commerce!

Julio Fuentes, President and CEO of the Chamber, praised those who made the list in a statement last Wednesday: “We are incredibly happy to award recognitions to the leaders in our Hispanic business community, and as a result, the economy continues to grow in the Sunshine State. In an ever-more competitive business environment, these 50 Hispanic honorees are extremely deserving of this recognition, as each of their unique stories and careers were destined to be celebrated and rewarded.”

“This was a complete shock,” said Julio, a Miami native who is of both Cuban and Puerto Rican heritage. “I had no idea I was even nominated. It’s a great honor to be so recognized.”

Other honorees include Diana Arteaga, Vice President of Government Relations and Community Affairs for Broward Health; Cesar Conde, Chairman of NBCUniversal International Group & Telemundo; and Jorge Gonzalez, Vice President of National Public Affairs for AT&T.

Here is a full list of the Top 50 recipients:

- Tony Argiz, MBAF Certified Public Accountants

- Diana Arteaga, Broward Health

- Josie Bacallao, Hispanic Unity

- Felipe Basulto, TD Bank

- Natalie Boden, BODEN

- Gaston Cantens, Florida Crystals

- Esmirna Caraballo, Esmirna’s Notary Accounting and Tax Services LLC

- Ana Carbonell, The Factor

- Carlos Carbonell, Echo Interaction Group

- Giselle Carson, Marks Gray P.A. Law Firm

- Carmen Castillo, SDI International Corp

- Adriana Cisneros, Cisneros Group

- Cesar Conde, NBCUniversal International Group & Telemundo

- Carlos Cruz, Converge Government Affairs

- Manny Diaz, Lydecker Diaz

- Eddy Dominguez, Resource Employment Solutions

- Manny Farach, McGlinchey Stafford

- Eduardo Fernandez, Eduardo Fernandez, Esq., MBA

- Rudy Fernandez, UM

- JC Flores, AT&T

- Lisa Garcia, Sachs Media Group

- Jorge Gonzalez, City National Bank

- Julio Gonzalez, Engineered Tax Services

- Adriana Gonzalez, Gonzalez & Cartwright, P.A.

- Wilfredo Gonzalez, U. S. Small Business Administration

- Marucci Guzman, Latino Leadership

- David Hernandez, Liberty Power

- Marlow Hernandez Cano, Cano Health

- Ivan Herrera, Univista Insurance

- Cynthia Hudson, CNN Espanol

- Tony Lima, SL7 Consulting

- Liliam M. Lopez, South Florida Hispanic Chamber of Commerce

- Martha Macias, You got my Hands

- Pete Maldonado, CHOMPS

- Jose Mas, MasTec

- Ricardo Morales, III, Morales Construction

- Lazaro Mur, The Mur Law Firm

- Al Ortero, Global Trade Chamber

- Rosie Paulsen, Rosie Paulsen Enterprises

- Helena Poleo, Influence Communications

- Bruno Portigliatti, Florida Christian University & Excellence Senior Living

- Beto Quintero, Quintero Partners

- Ana Rivera, Polk Puerto Rican Chamber of Commerce

- Albert Rodriguez, Spanish Broadcasting Services

- Jay Rosario, Celebrity Nissan/ Wesley Chapel Nissan

- Dr. Carlos Sanchez, PCSI

- Nora Sandingo, Nora Sandigo Children Foundation

- Bob Unanue, Goya Foods

- Alex Valencia, We Do Web Content

- Clark Vargas, C Vargas and Associates

Congratulations, Julio!