As a commercial building owner, it is crucial to understand the benefits of cost segregation in order to manage tax liability and maximize the value of your properties. In this article, we will outline the importance of cost segregation and provide real-world examples to show just how much money commercial building owners can save.

Commercial Building Tax Concerns

Depreciation schedules can be a major tax concern for commercial building owners. Because depreciation is used to determine the tax deductions available for a building, improper calculation or documentation of depreciation could result in a significant additional tax liability.

Commercial building owners who classify their entire building as real property will have longer depreciation schedules and lower tax deductions than owners who accurately reclassify certain components as personal property or land improvements. Proper asset classification can be achieved through cost segregation, which the IRS recognizes as a preferred strategy for determining the tax treatment of building components. Neglecting to perform cost segregation analysis can result in paying significantly higher taxes than necessary.

How Cost Segregation Helps

By utilizing cost segregation, commercial building owners can identify and accelerate the depreciation of certain building components, which reduces taxable income and thereby lowers tax liability. Reducing the recovery period of such components often results in increased tax deductions in the first few years of a building's useful life and frees up cash flow for other investments.

In addition to tax benefits, cost segregation provides valuable information about the building's energy efficiency, maintenance and repair costs, construction cost overruns and more. This information can help building owners make informed decisions about their properties.

Case Study Examples

Engineered Tax Services has a catalog of 15+ commercial building case studies that showcase real-world results from past clients. Below are a few examples:

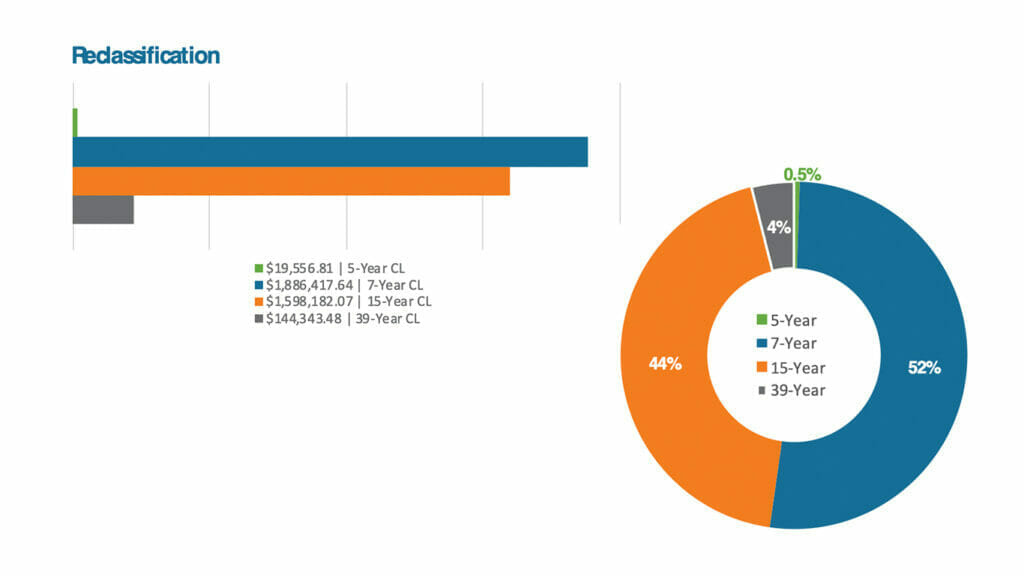

Self-Storage Building

This 100,000 square-foot self-storage facility was purchased in 2018 for a little over $3.5 million. Our engineers analyzed various components of the property to assign accurate depreciation schedules. This resulted in a significant portion of the taxable basis being accelerated to a 5-, 7- or 15-year class life depreciation schedule, as shown in the following charts.

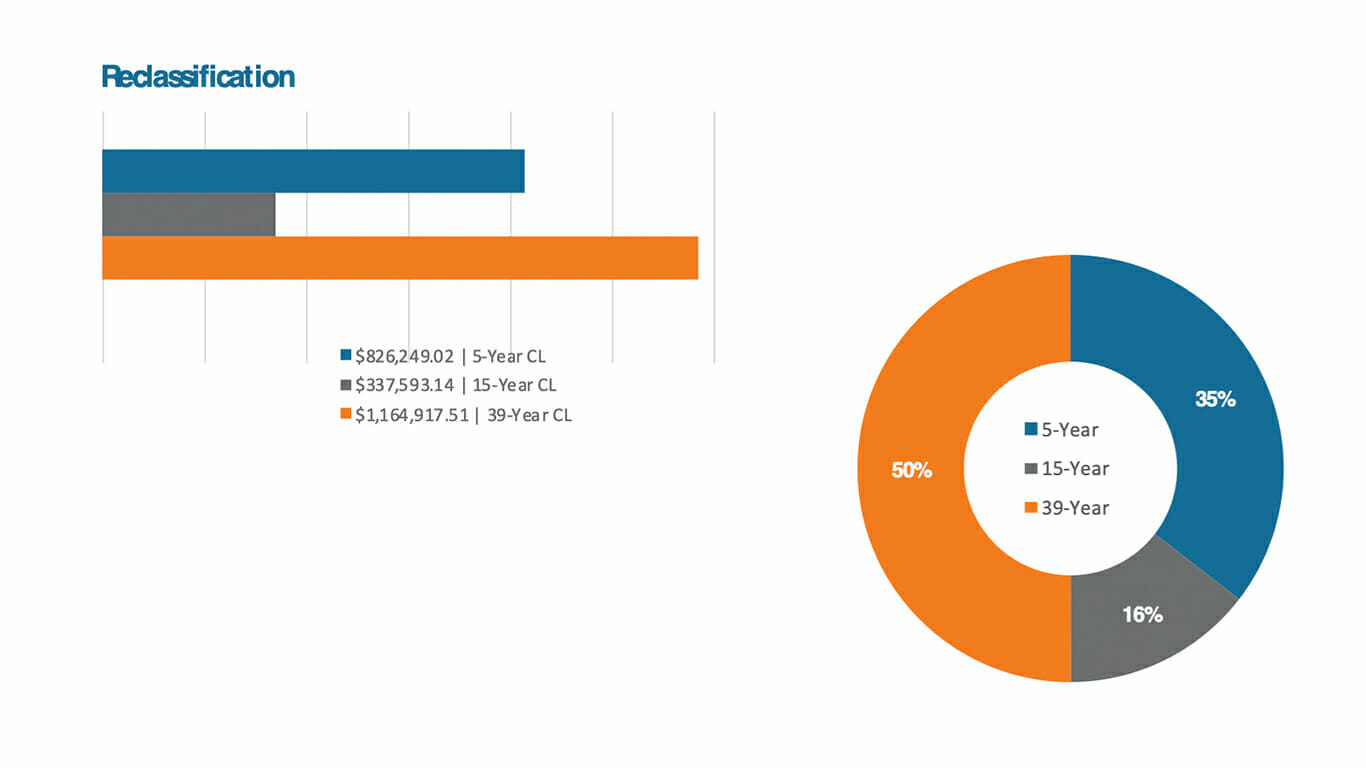

Medical Office

We helped investors in this $2.3 million medical office accelerate depreciation from just $2,488 to well over $1 million, resulting in valuable tax savings and increasing overall cash flow.

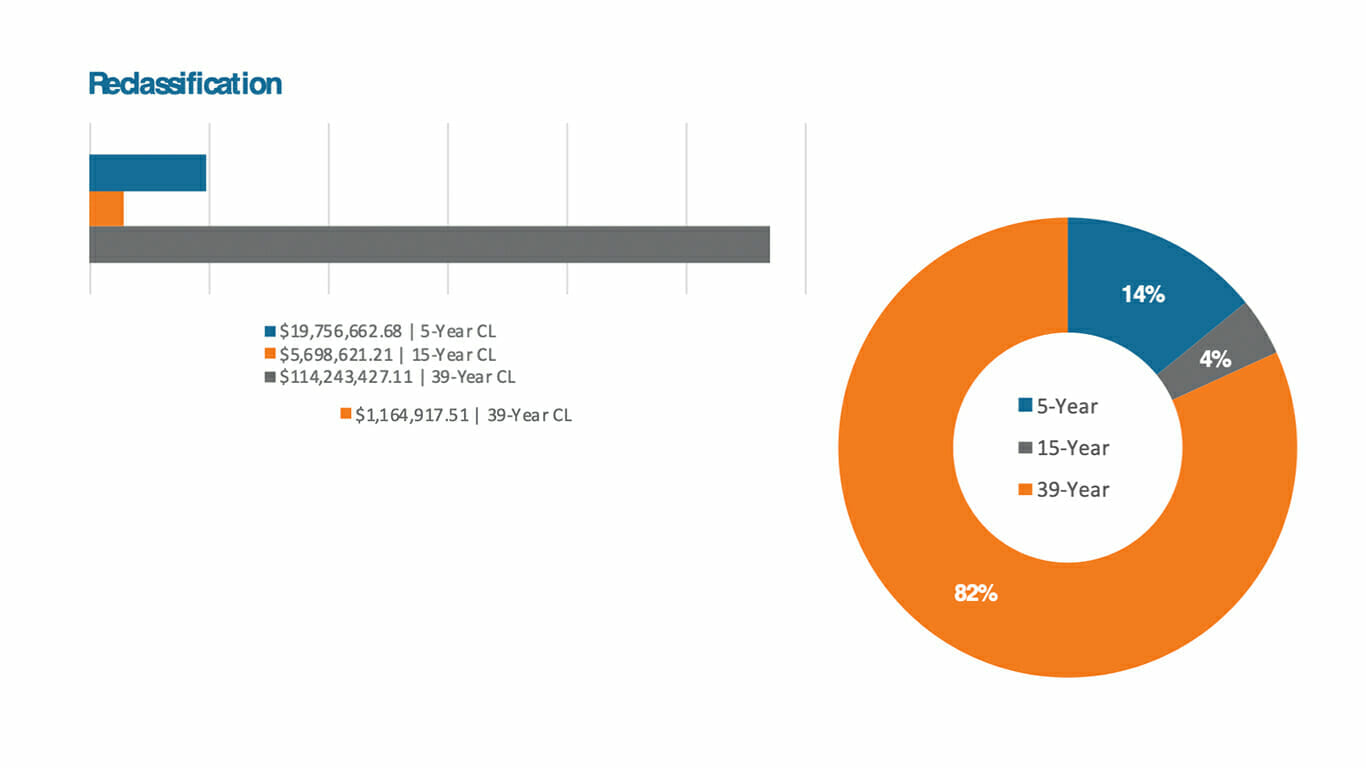

Multi-Use Property

This $1.6 million property consists of several multi-level buildings including retail, restaurants and office space. Our engineers evaluated each building and examined all relevant components to apply proper depreciation schedules. The results are outlined below.

In conclusion, cost segregation is a valuable tool for commercial building owners to manage their tax liability and maximize the value of their properties. By accurately classifying certain building components as personal property or land improvements, owners can reduce taxable income, lower tax liability and free up cash flow for other investments. In addition to tax benefits, cost segregation provides valuable information about the energy efficiency, maintenance and repair costs and other important data that can help building owners make informed decisions about their properties.

Engineered Tax Services is a leading specialty tax firm with extensive cost segregation expertise. If you’re interested in exploring possibilities, we would be glad to offer you a free cost segregation feasibility study. Contact us today to get started.