Cost Segregation for Office Buildings

As an office building owner, navigating the complex world of taxes can be a daunting task. With commercial properties subject to a variety of tax rules and regulations, it's easy to get lost in the details and lose sight of your bottom line. That's where cost segregation comes in.

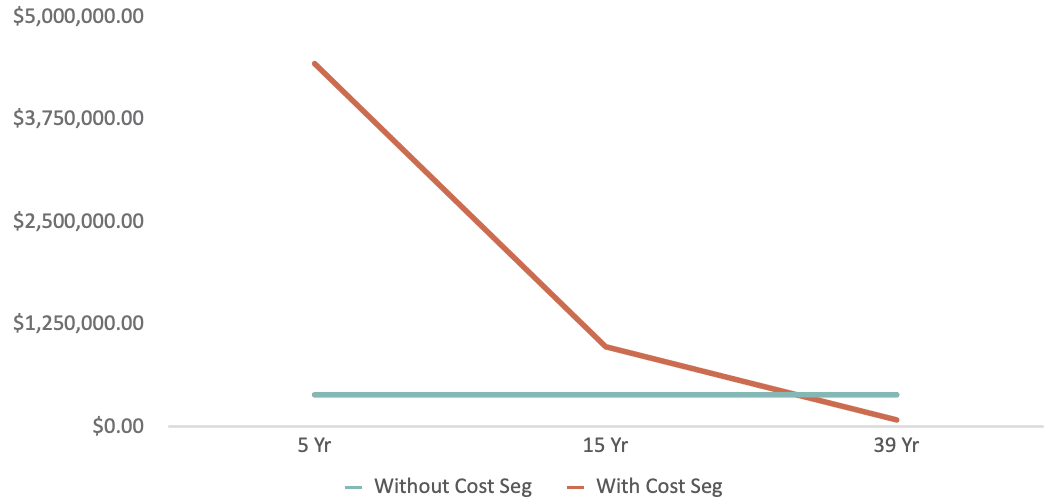

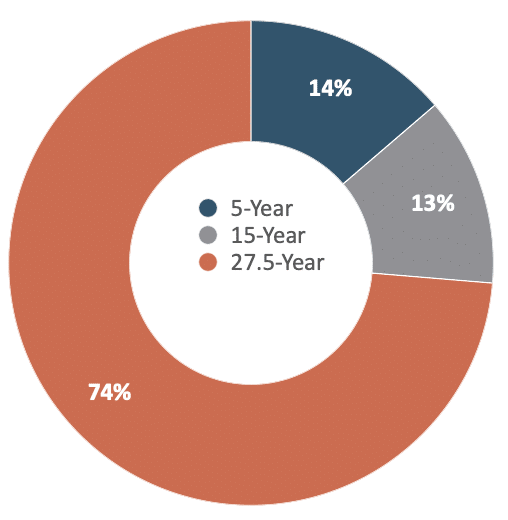

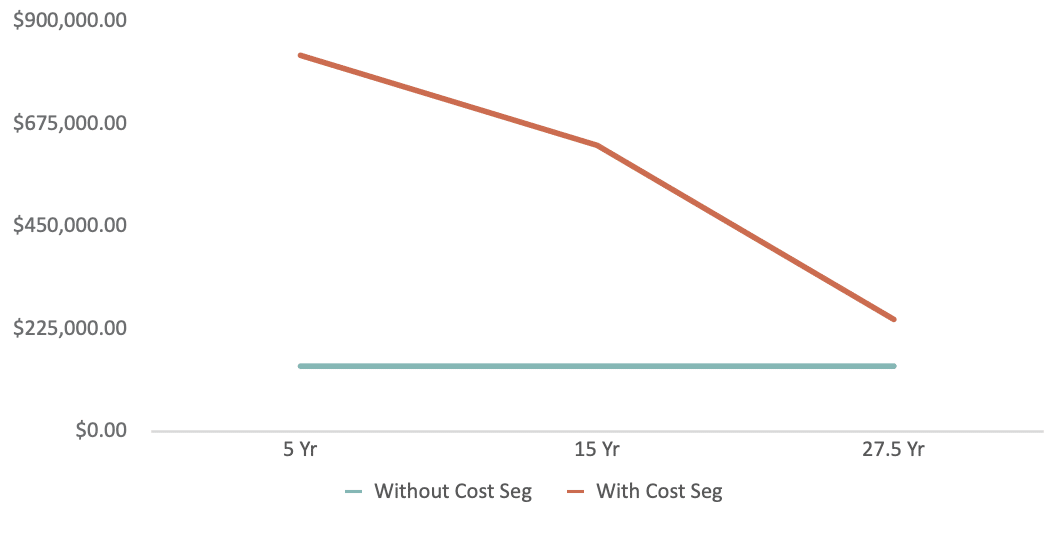

This tax planning strategy allows property owners to accelerate depreciation deductions and reduce their tax liability by breaking down the costs of a building into different categories and assigning them different depreciation periods.

Office Building Tax Concerns

Office building owners face numerous tax concerns that can impact their bottom line. One of the most significant concerns is property taxes. The value of an office building is often based on the assessed value of the property, which is used to calculate property taxes.

Owners must be aware of the tax assessment process in their area to ensure that their property is valued accurately and that they are not overpaying in taxes. In addition, owners may be able to appeal their property tax assessment if they feel that it is too high, which can result in significant savings.

Another tax concern faced by office building owners is income taxes. Owners need to stay up to date on complex tax rules to ensure that they are maximizing their deductions and minimizing their tax liability. This can be particularly challenging for owners who own multiple properties or who have complex ownership structures.

Finally, recapture can also be a concern for office building owners. This occurs when a taxpayer claims depreciation deductions on a property and then sells the property at a gain before the end of its useful life. In this situation, the taxpayer may be required to pay back some or all of the depreciation deductions that were previously claimed. However, by using cost segregation, owners can identify assets that can be depreciated over a shorter period, which reduces the risk of recapture.

How Cost Segregation Helps

Cost segregation is a tax planning strategy that allows property owners to accelerate depreciation deductions and reduce their tax liability. This is achieved by breaking down the costs of a building into different categories and assigning them different depreciation periods.

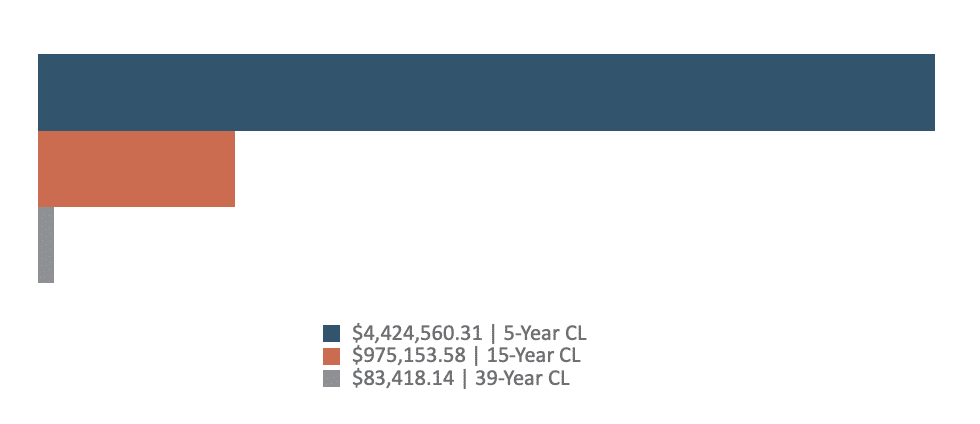

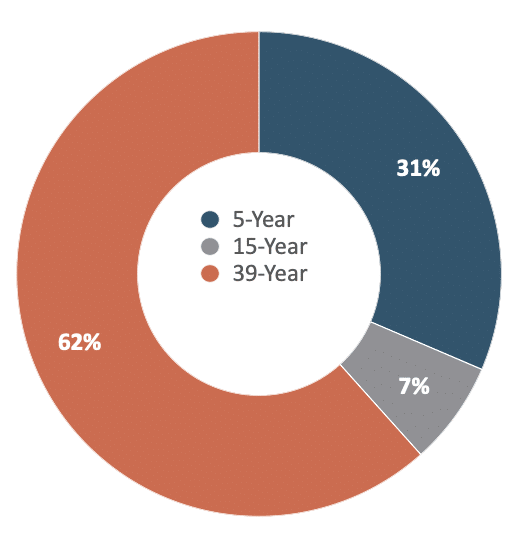

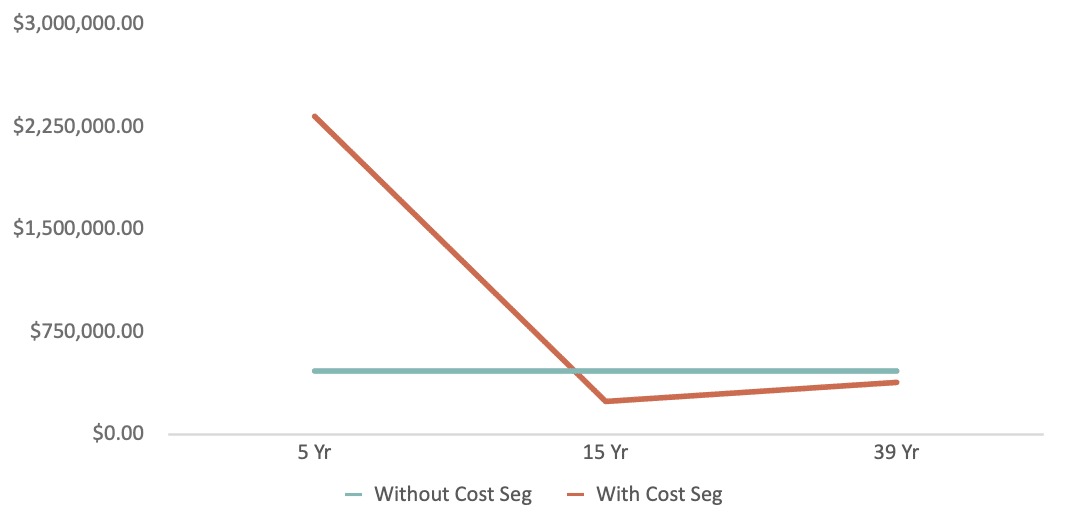

One of the most significant benefits of cost segregation is the ability to front-load depreciation deductions. Commercial buildings typically have a long depreciation period of 39 years. However, some items within the building, such as fixtures, carpeting or electrical systems, may have shorter depreciation periods. By allocating these costs to shorter depreciation periods, owners can reduce their tax liability in the short term.

Cost segregation can also help owners identify tax savings opportunities. By conducting a cost segregation study, owners can identify assets that may be eligible for bonus depreciation or other tax credits. This can further reduce their tax liability and improve their bottom line.

Case Study Examples

To illustrate the benefits of cost segregation, let's take a look at some real-world examples:

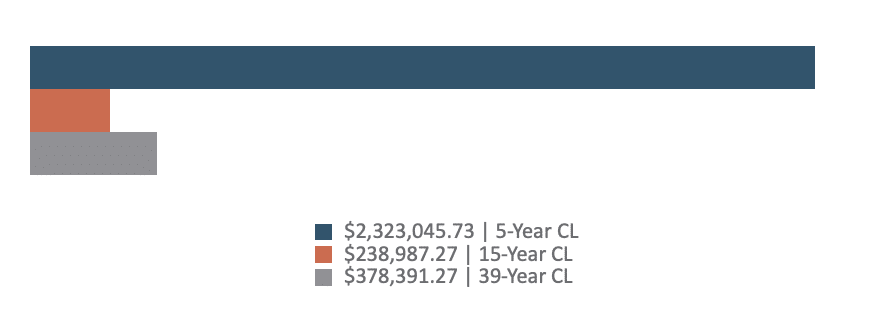

Our first case study involves a $14 million office building in Denver, CO. Applying a cost segregation study to this building allowed the property investors to accelerate depreciation for the first year to $5,483,132.03, resulting in significant tax savings.

| Purchase Price of Building | Building Type | Building Location | First-Year Tax Savings |

|---|---|---|---|

| $14 Million | Office Building | Denver, CO | $5,483,132.03 |

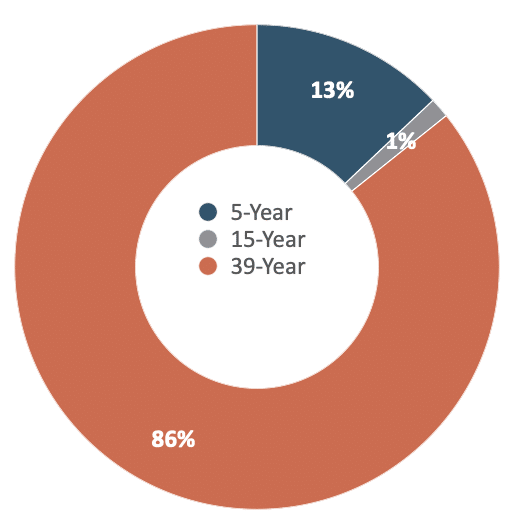

Similarly, in our second case study, a cost segregation study was applied to an $18 million office building in West Palm Beach, FL. The property investors accelerated depreciation for the first year to $2,940,424.27, reducing their tax liability and freeing up capital to invest in their business.

| Purchase Price of Building | Building Type | Building Location | First-Year Tax Savings |

|---|---|---|---|

| $18 Million | Office Building | West Palm Beach, FL | $2,478,885.81 |

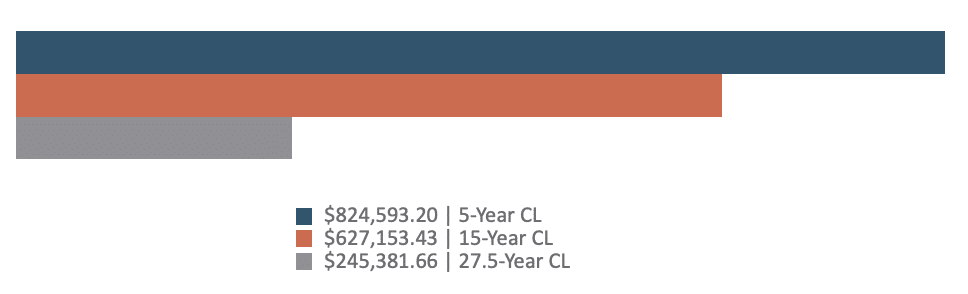

Finally, our third case study involves an $11.5 million office building in Fort Lauderdale, FL. Applying cost segregation helped the property investors to speed up depreciation for the first year, resulting in a depreciation amount of $1,697,128.29.

| Purchase Price of Building | Building Type | Building Location | First-Year Tax Savings |

|---|---|---|---|

| $11.5 Million | Office Building | Fort Lauderdale, FL | $1,554,313.03 |

Conclusion

If you’re an office building owner looking to reduce your tax liability and increase your cash flow, Engineered Tax Services is here to help. Our team of experts specializes in conducting cost segregation studies, and all our work is fully audit defendable.

Don't let long depreciation periods hold you back. Contact us today to learn more about how we can help you maximize your tax savings and improve your bottom line. Our team has a proven track record of helping commercial building owners across the country save money on their taxes through cost segregation studies.