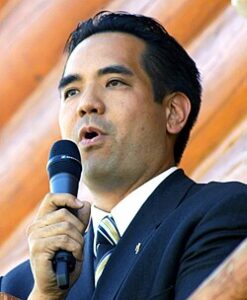

This week, tax reform expert and CEO of Engineered Tax Services, Julio Gonzalez, worked in D.C. – meeting with members of Congress and Senate to discuss tax policy relative to 179D energy tax extender and the need to change tax policy related to R&D tax credits.

Mr. Gonzalez’s meetings included private dinners with U.S. Congressman, Jim Renacci regarding real estate tax policy.

Julio also met with other Tax Policy Leaders:

- Lisa Costello, Vice President & Cindy Vosper Chetti, Senior Vice President — Political Affairs National Multifamily Housing Council

- Steve Hall, Vice President, Government Affairs — American Council of Engineering Companies

- Stan Kolbe, Vice President – Sheet Metal and Air Conditioning

- Chirag Shah, Vice President-Government Affairs, Jordan Heiliczer, Director, Government Affairs — Asian American Hotel Owners Association, Inc. (AAHOA)

- Koch Brothers, The Seminar Network Reception — Emily Seidel, CEO of Americans for Prosperity — Policy and Political Landscapes

- Jose Nino, US Hispanic Chamber of Commerce Gala Reception

- Senator Toomey

- Senator Cardin

“Tax Policy needs significant reform in the areas of 179D and R&D. I’m assisting with coalition building to gather support on the hill in these areas and other related real estate tax policy,” said Mr. Gonzalez.

Julio also visited the White House with the MPAC contingency to hear from the administration on tax policy updates.

And headlined as panelist for the Multi-Family Housing Council’s Political Action Committee (PAC). You can see the list of panelists below.

- Annette Davis-Jackson, State House-GA

- Bishop Harry Jackson, High Impact Leadership

- Claude Allen, Former White House Domestic Policy Advisor (Bush 43)

- Congressman Ken Buck

- Congressman Mike Conway, Chairman Agriculture Committee

- David Byrd, Sr. Advisor- HUD Secretary Ben Carson

- Deputy Assistant Secretary, Dr. Andrea Ramirez- US Dept of Education

- Edith Jorge- National Director Strategic Initiatives RNC

- Former Lt. Governor Jennifer Carrol

- Frances Middleton, President- Christian Media

- Frank Gaffney, Center for Security Policy

- Gina Barr- Urban Engagement, RNC

- Harry Alford- National Black Chamber of Commerce

- Herman Cain, Former U.S. Presidential Candidate & Business Executive)

- Honorable. Mark Cowan

- Honorable. Phil Bond, Former Under Secretary, U.S. Dept. of Commerce

- Jim Martin, 60 Plus

- Jimmy Chue, Trump Asian American Diversity Coalition

- Jimmy Kemp, Kemp Foundation

- Juan O’Leary, RNC

- Julio Gonzalez – Trump Administration Tax Reform Taskforce

- Kareem Lanier, Urban Revitalization Coalition

- Katrina Pierson, Senior Advisor at

- Donald J. Trump for President, Inc.

- Linda Hansen, (fmr) Deputy Campaign Manager Herman Cain

- Mario Lopez, Hispanic Leadership fund

- Mark Cowan, (fmr) CIA Case Officer & Legislative Counsel

- National Republican Congressional Committee

- Pastor Darrell C. Scott

- Raynard Jackson, Black Americans For A Better Future

- Rev. Bill Owens, President Coalition of African American Pastors

- RNC Chairwoman Ronna Romney McDaniel

- RSLC Republican State Leadership Committee

- Senator Fernanda Cabal (Colombia)

- Star Parker, Founder- C.U.R.E

- The National Republican Senatorial

- Thuy Lowe- Fmr Congressional Candidate (FL)

- U.S. Treasurer, Jovita Carranza

For the latest tax policy updates from Mr. Gonzalez and Engineered Tax Services, continue to follow the blog. You can also call (800) 236-6519.