This week Engineered Tax Services (ETS) and Gonzalez Family Office (GFO), continued their joint work with the National Multi Housing Council, (NMHC). Last week ETS participated in the NMHC research forum. NMHC, like ETS, is dedicated to education and training on how Real Estate Investors reach maximum tax efficiency thus increasing wealth through strategies which are important by helping provide needed housing for Americans.

Multi-Family Housing Council Meeting Continues

This week ETS continued meeting with NMHC this time at their Washington, D.C. offices. Participating at NMHC meetings included Lisa Costello, Vice-President of Political Affairs and Cindy Vosper Chetti, Vice-President of Government Affairs. These conversations focused on the NMHC and ETS continued work on tax reform.

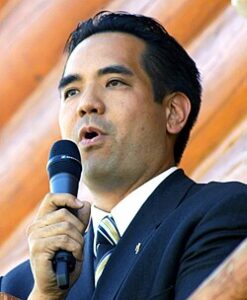

Julio Gonzalez, Tax Reform Expert, CEO and Founder of Engineered Tax Services and Gonzalez Family Office, updated the NMHC team on his work with various legislative and governmental agencies on much needed technical corrections on the recently passed Tax Cuts and Jobs Act (TCJA).

NMHC has a high interest in changes needed to correct mistakes hastily written into the law, such as a reconciliation between structural depreciation time frames regarding new construction or new purchases of existing multi-family buildings.

Joining into the tax review discussions from NMHC were Matthew Berger, Vice-President Tax and Dave Borsos, Vice-President Capital Markets. These discussions also focused on the new Opportunity Zones created by the tax bill. While final regulations are pending, the Zones may provide meaningful tax advantages for long-term investing within designated low-income areas.

ETS Shares Goals with NMHC

Joining Mr. Gonzalez in Washington, DC was Jamie Pope, Director of Business Development for ETS. “Our ongoing participation with NMHC in these important tax matters, is a continuation of our shared goals of helping investors harvest tax advantages to increase investments in the housing and jobs markets,” said Mr. Pope.

ETS also joined National Multi-Family Housing Council’s Political Action Committee (PAC) to further help lobby Congress, Senate, and Administration on tax policy concerns associated with real estate investing. There were many VIPs at this event that Mr. Gonzalez and Mr. Pope had a chance to listen to and speak with such as:

- Congressman Mike Conway, Chairman Agriculture Committee

- RNC Chairwoman Ronna Romney McDaniel

- Herman Cain (former U.S. Presidential Candidate & Business Executive)

- S. Treasurer, Jovita Carranza

- (fmr) Lt. Gov. Jennifer Carrol

- Star Parker, Founder- C.U.R.E

- Jimmy Kemp, Kemp Foundation

- Katrina Pierson

- Pastor Darrell C. Scott

- David Byrd, Sr. Advisor- HUD Secretary Ben Carson

- Claude Allen (fmr) White House Domestic Policy Advisor (Bush 43)

- Frank Gaffney, Center for Security Policy

- Jim Martin, 60 Plus

- Bishop Harry Jackson, High Impact Leadership

- Deputy Assistant Secretary, Dr. Andrea Ramirez- US Dept. of Education

- Harry Alford, National Black Chamber of Commerce

- NRCC

- NRSC

- RSCL

- Phil Bond, (fmr) Under Secretary, U.S. Dept. of Commerce

- Mark Cowan

Issues Mr. Gonzalez is Working on:

- Pass through 199A grouping rules

- Opportunity Zone regulation

- Depreciation methods

- Affordable housing tax credits

- Technical corrections

- Energy Tax Policy

- Design Tax Credits

- Interest expensing concerns with development

Along with other tax issues impacting Multi-Family Housing.

We are dedicated to working with NMHC to make sure tax and regulation policy continues to be refined and improved under the current administration with the continued focus on growth in the industry,” said Mr. Gonzalez.