Case Study: Cost Segregation Analysis for a Historic Apartment Complex in Tustin, California

Narrative In April 2021, investors acquired a historic apartment complex in Tustin, California, to capitalize

Welcome to our extensive collection of cost segregation case studies and examples at Engineered Tax Services. We specialize in helping businesses across various industries maximize their potential for cost segregation. Our team of experts understands the unique components of different property types, and we work closely with our clients to ensure they accurately depreciate all building components.

Our real-world case studies and cost segregation study examples highlight the significant benefits of this strategy across various property types, including apartment complexes, manufacturing facilities, warehouses, shopping malls, office buildings, auto shops, restaurants, and more. Each case study and example provides a detailed look at how cost segregation can be applied to a specific property type, emphasizing the potential tax savings and financial advantages.

Whether you are a property owner, a tax professional, or someone interested in learning more about cost segregation, our case studies and examples offer valuable insights into the process and benefits. By reviewing these detailed accounts, you will gain a clear understanding of how cost segregation can contribute to maximizing tax savings and improving your financial outcomes.

For personalized assistance and to learn more about how cost segregation can benefit your property, contact us today. Our experts are ready to help you navigate the complexities and achieve the maximum potential for tax savings.

Narrative In April 2021, investors acquired a historic apartment complex in Tustin, California, to capitalize

Narrative In 2024, the owners of a mobile home park in Florida undertook strategic tax

Narrative In 2021, the owners of an apartment complex located in Florida sought to optimize

Narrative In 2024, the owner of an office building in West Palm Beach, Florida undertook

Narrative In 2024, the owners of a mixed-use residential/commercial property in Miami, Florida, undertook strategic

Narrative In 2018, the owners of a medical office building in Okeechobee, Florida undertook a

Narrative In 2019, the owners of a self-storage facility in La Pine, Oregon engaged Engineered

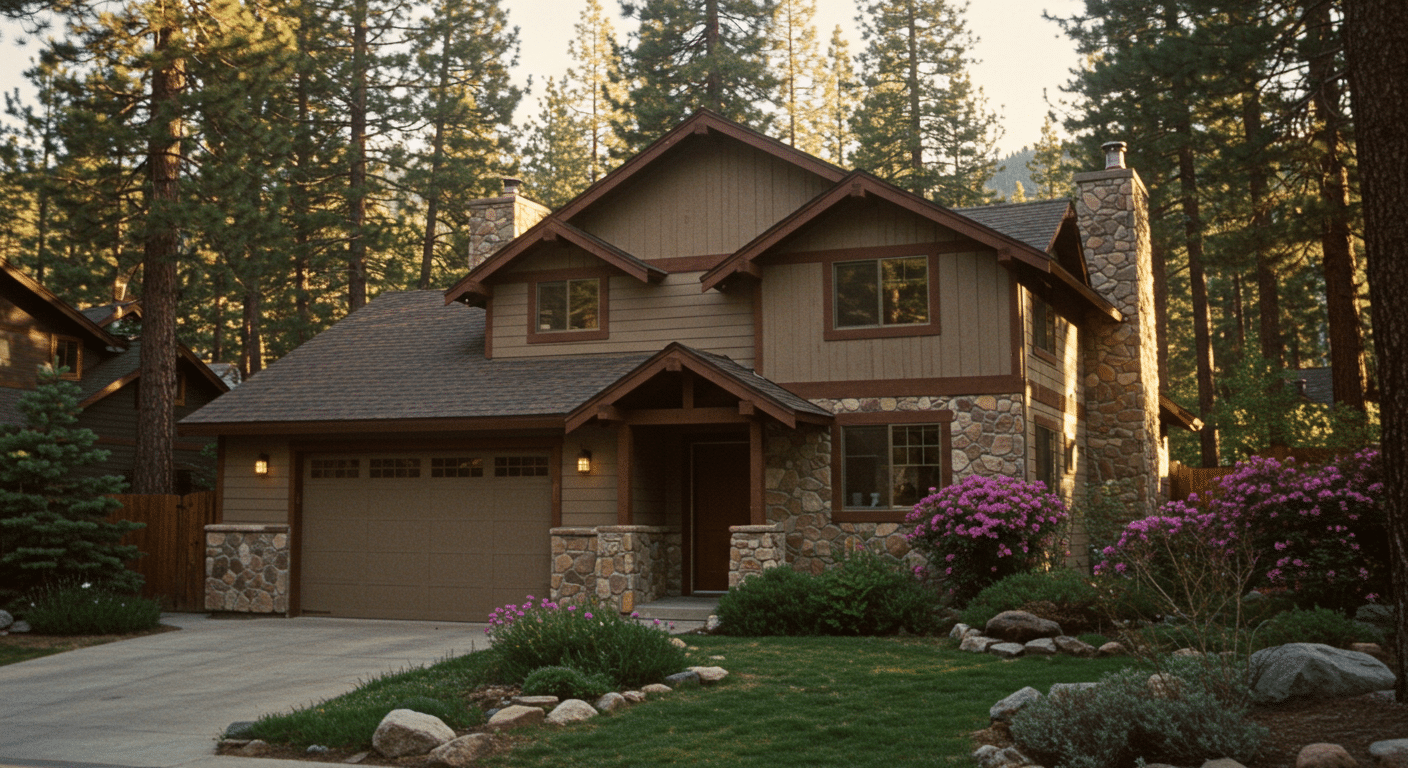

Narrative In 2024, the owners of a two-story residential property in Tahoe Vista, California engaged

Narrative In 2024, the owners of a warehouse facility in Richmond, Virginia, undertook strategic tax

Narrative In 2024, the owners of a standalone retail property in Jacksonville, Florida undertook a