Case Studies: Hotels

These real-world case studies provide examples of hotels, motels, inns, and resorts that have benefited from cost segregation studies. You’ll also find case studies documenting how hotels and motels have claimed 179D energy tax credits.

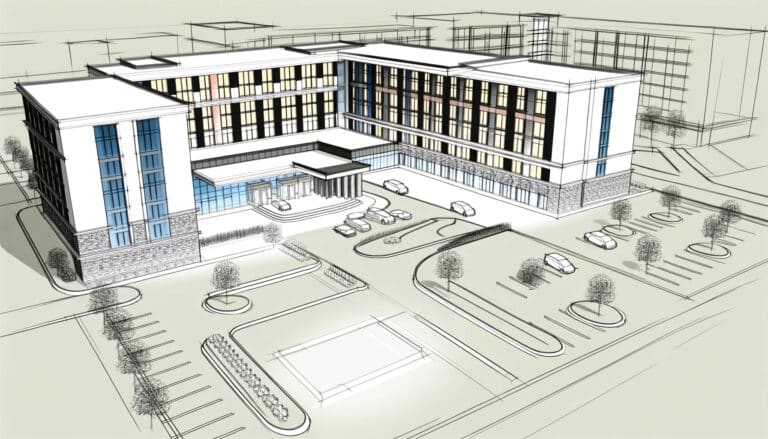

Hotel Case Studies

Hotel and hospitality property owners can significantly increase their portfolio’s liquidity by capturing specialized tax incentives designed for high-density lodging facilities. Engineered Tax Services helps hospitality investors unlock immediate cash flow by identifying the vast array of personal property and land improvement assets within a hotel that qualify for accelerated depreciation. From luxurious interior finishes to complex mechanical systems and outdoor amenities, ETS utilizes an engineering-based approach to front-load tax deductions. This strategic influx of capital is essential for funding the recurring Property Improvement Plans (PIPs) and renovations required to maintain brand standards and guest satisfaction.