- Automotive Industry

R&D Tax Credits for Automotive Companies

From electric vehicles to autonomous driving technology, automotive R&D activities qualify for substantial tax credits that can accelerate your innovation roadmap.

Average Credit Value

$500K - $2M+

Why Automotive Companies Benefit

The automotive industry's rapid evolution in electrification, autonomy, and sustainability creates extensive R&D tax credit opportunities

Electric Vehicle Innovation

Aerospace companies work at the forefront of technology, developing systems that push the boundaries of what's possible.

Autonomous Systems

Creating self-driving technology, ADAS features, and connected vehicle systems generates significant credit opportunities.

Safety & Efficiency

Improving fuel efficiency, crash safety systems, and emissions reduction technologies qualify for federal and state credits.

Qualifying R&D Activities

Common automotive industry activities that qualify for R&D tax credits

Electric & Hybrid Vehicle Development

- Designing advanced battery management systems

- Developing electric motor efficiency improvements

- Creating regenerative braking technologies

- Optimizing thermal management systems

- Developing fast-charging capabilities

Autonomous & Connected Vehicles

- Developing computer vision systems

- Creating sensor fusion algorithms

- Designing V2X communication protocols

- Implementing machine learning for navigation

- Developing cybersecurity for connected cars

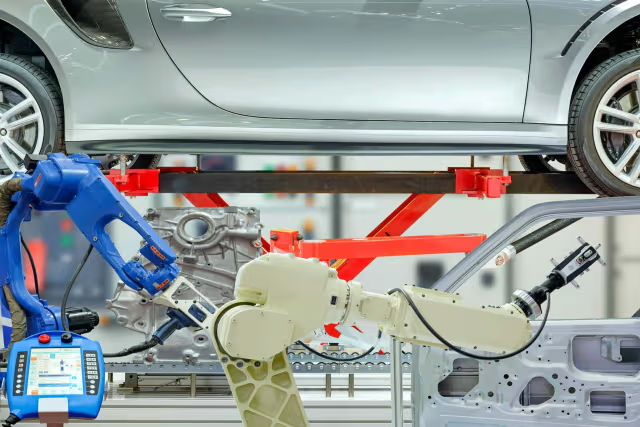

Materials & Manufacturing Innovation

- Developing lightweight composite materials

- Creating advanced manufacturing processes

- Designing 3D printing for automotive parts

- Improving paint and coating technologies

- Developing sustainable materials

Safety & Performance Systems

- Creating advanced driver assistance systems

- Developing crash avoidance technology

- Designing adaptive suspension systems

- Improving aerodynamic efficiency

- Creating noise reduction technologies

This is not an exhaustive list. Many other automotive R&D activities may qualify.

Success Stories

Real examples of automotive companies benefiting from R&D tax credits

$980,000

EV Motors Inc.

Developed solid-state battery technology increasing range by 50% while reducing charging time to 15 minutes.

$1,450,000

AutoTech Solutions

Created Level 4 autonomous driving system with advanced sensor fusion and real-time decision making capabilities.

$625,000

Green Auto Manufacturing

Developed bio-based composite materials reducing vehicle weight by 30% while maintaining structural integrity.

Ready to Accelerate Your R&D Tax Credits?

Our specialized team understands the unique challenges and opportunities in automotive R&D. Let us help you maximize your tax savings while you drive the future of transportation.