For those in the car wash industry seeking ways to boost their financial performance, an often overlooked yet highly beneficial tax strategy exists: cost segregation for car washes. This IRS-approved tax planning technique can result in substantial tax savings for car washes, offering unique benefits to car wash owners and significantly enhancing their bottom line.

In this blog post, we'll explore the concept of cost segregation and its role in reducing car wash tax liability. Furthermore, we'll dive into how you can leverage this approach to speed up your car wash equipment depreciation and maximize your car wash tax deductions.

The Basics of Cost Segregation for Car Washes

Cost segregation, at its core, is a strategic tax-saving tool. The main purpose of cost segregation is to increase your cash flow by accelerating depreciation deductions and deferring federal and state income taxes. This process involves analyzing your property, identifying specific assets and reclassifying them to speed up their depreciation timeline.

Normally, the depreciation period for a commercial building (such as a car wash) is 39 years under the Straight Line Method. However, a cost segregation study can identify certain parts of your property that qualify for shorter depreciation periods under the Modified Accelerated Cost Recovery System (MACRS) method for 5, 7 or 15 years. By accelerating the depreciation of these assets, you can significantly reduce your car wash tax liability in the early years of property ownership, freeing up cash for other business needs.

Components of Cost Segregation

Components that can be identified for accelerated depreciation include:

- Land improvements

- Non-structural elements of buildings

- Personal property within the building

- Certain indirect construction costs

By examining and classifying these components correctly, cost segregation allows you to reap the benefits of earlier depreciation deductions, essentially putting more money back into your pocket faster.

How Does Cost Segregation Benefit Car Wash Owners?

While cost segregation can provide significant tax savings for a range of businesses, it's uniquely advantageous for car washes. Car wash facilities often contain a multitude of assets eligible for accelerated depreciation, such as:

- Car wash systems

- Water reclamation systems

- Drying systems

- Automated teller machines

- Other specialized equipment

Car washes have a unique composition of assets compared to many other types of businesses. A large portion of the investment in a car wash is not in the building itself but in the specialized equipment necessary to operate the business.

Car wash equipment and machinery can be separated from the building structure in a cost segregation study, allowing it to be depreciated over a shorter life cycle. In other words, cost segregation identifies and accelerates depreciation of these specific components in car washes, generating immediate tax deductions to reduce your tax liability.

Technology and Equipment Upgrades

With many car wash facilities utilizing cutting-edge technology and constantly upgrading their equipment to remain competitive, the benefits of cost segregation are continuously renewed. Every time a piece of eligible equipment is replaced or upgraded, a new opportunity for accelerated depreciation arises.

And here's where the rubber meets the road: the potential tax savings from cost segregation are substantial, often ranging from 60 to 100%. Whether you've just started your car wash business or it's been around for years, implementing cost segregation for car washes can unlock substantial tax savings, thereby significantly improving your cash flow.

Understanding Reclassification and Bonus Depreciation

As we delve deeper into the intricacies of cost segregation, two terms that invariably surface are “reclassification” and “bonus depreciation.” Understanding these concepts is crucial in comprehending how cost segregation can be a powerful tool in managing a car wash's tax liabilities.

Reclassification

Reclassification, as the name suggests, involves reclassifying certain property elements from real property to personal property. This is significant because personal property typically has a shorter lifespan for depreciation purposes than real property.

For instance, certain machinery and equipment in a car wash that might have been classified as part of the building can be reclassified as personal property and depreciated over a much shorter period—say 5, 7 or 15 years, instead of the standard 27.5 or 39 years. This acceleration in depreciation schedule leads to larger deductions in the early years of an asset's life, consequently reducing the tax burden.

Bonus Depreciation

Bonus depreciation is another key strategy in a cost segregation study. The Tax Cuts and Jobs Act (TCJA) of 2017 made a significant change in this area, currently allowing businesses to write off 80% of the cost of qualifying property in the year it's placed in service. This is a substantial benefit that, when paired with a cost segregation study, can lead to hefty tax write-offs for car wash operators.

However, it's worth noting that bonus depreciation isn't here to stay forever. As per the current tax code, the bonus depreciation will decrease by 20% each year until it's completely phased out by the end of 2026. While this phase-out won't affect properties placed in service before the phase-out begins, it does have implications for future property acquisitions and improvements.

Nevertheless, even with the phase-out of bonus depreciation, the benefits of cost segregation remain. It continues to be a powerful strategy that can yield considerable tax savings.

Cost Segregation for New and Existing Car Wash Properties

There's a common misconception that cost segregation only benefits new properties. While it's true that cost segregation can greatly assist those embarking on new car wash builds or purchases, it's equally important and advantageous for owners of existing car washes. Let's delve into how this strategic tax tool can be harnessed effectively for both new and existing car wash facilities.

Cost Segregation for New Car Washes

For new constructions or acquisitions, cost segregation can offer significant tax savings right from the start. By conducting a cost segregation study during the planning or construction phase, you can ensure that assets are correctly categorized from the outset. This early categorization accelerates depreciation, leading to substantial tax savings in the initial years of ownership when the cash flow impact is often most valuable.

Cost Segregation for Existing Car Washes

But what if you own an existing car wash? Can cost segregation still be beneficial? The answer is a resounding “yes.” Interestingly, properties purchased, built or remodeled within the last 15 years are prime candidates for a cost segregation study. This implies that even if you bought your car wash facility a decade ago, there's a high probability that a cost segregation study could yield considerable tax savings.

In the case of existing properties, a cost segregation study can lead to what is known as a “catch-up” depreciation deduction. Essentially, this means that you can claim the additional depreciation you could have taken in previous years had a cost segregation study been conducted at the time of purchase or construction. The great news is that this “catch-up” deduction can be claimed in the year the cost segregation study is conducted, without having to amend prior year tax returns.

Case Study

To give a more concrete understanding of the immense benefits of cost segregation, let's look at a real-life example of a car wash business in Marble Falls, TX that utilized this financial strategy to its advantage.

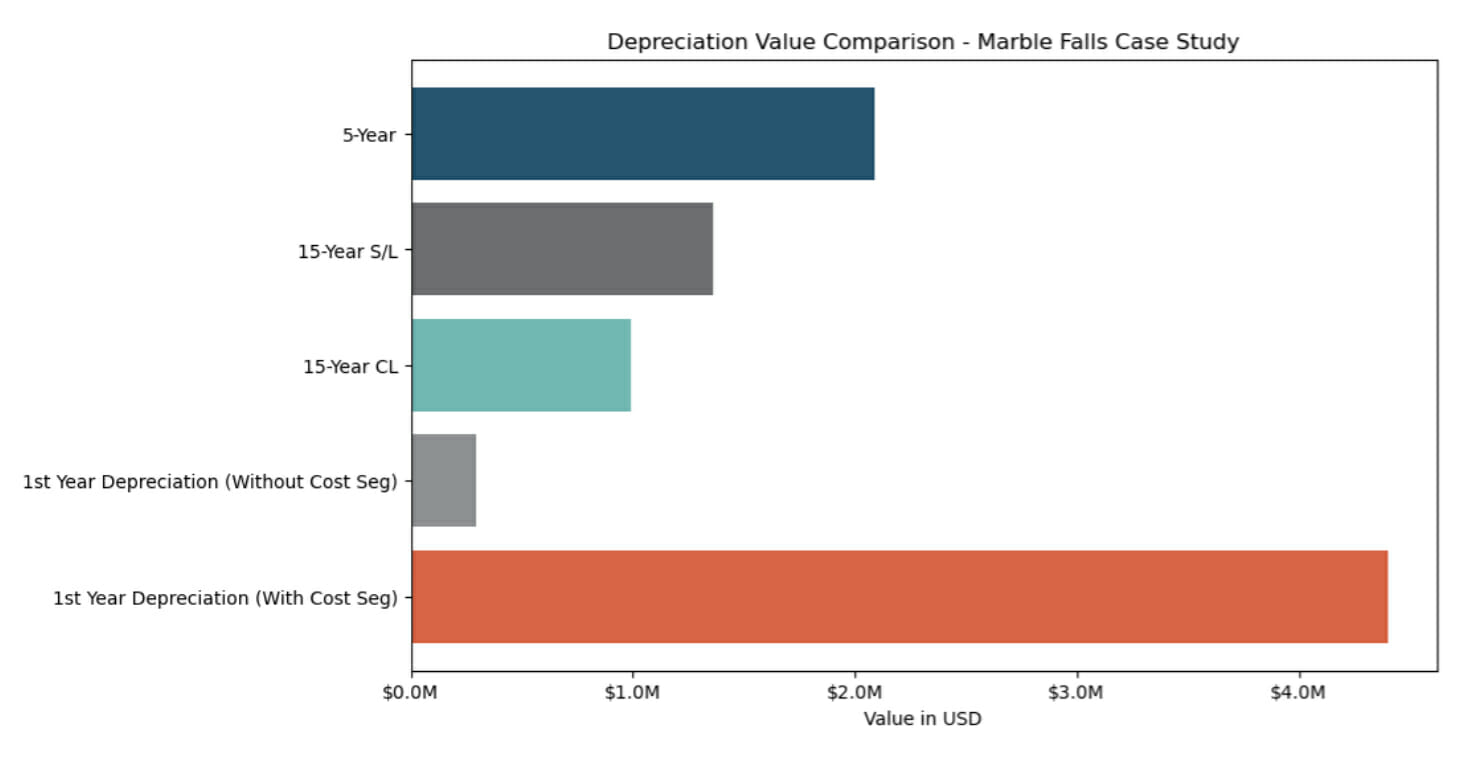

The car wash facility in question was purchased in 2021 for $4.4 million. Using traditional straight-line depreciation methods, the first-year depreciation value would have amounted to approximately $293,200. However, with the assistance of Engineered Tax Services, a much more financially advantageous approach was taken.

Rather than treating the car wash facility as a single asset with a uniform rate of depreciation, the team at Engineered Tax Services segmented the property into its constituent parts, each with its own depreciation rate. This cost segregation study led to a significant reclassification of the car wash’s value into shorter-life categories. The property reclassification was as follows:

- 5-year category: $2,088,613.35

- 15-year straight-line (S/L) category: $1,360,069.42

- 15-year conservation law (CL) category: $993,317.23

The overall effect of this reclassification was extraordinary. Instead of a first-year depreciation value of $293,200, the cost segregation study facilitated a vastly improved first-year depreciation value of approximately $4.4 million.

The ROI of this case study is self-evident. By moving from the traditional straight-line method of depreciation to a cost segregation approach, the car wash operator was able to access immediate tax savings equivalent to the entire initial investment in the facility. This provided a significant boost to the cash flow of the business.

This case study serves to underscore the potency of cost segregation in unlocking tax savings, particularly in the car wash industry. It is an effective tax strategy that can yield significant savings, bolstering the financial health of businesses in this sector.

Conclusion

In conclusion, cost segregation offers unique benefits for car wash operators. It presents an exceptional opportunity to reduce tax liability and increase cash flow by identifying and accelerating depreciation on specific components of the property. The potential for tax savings is impressive, ranging from 60 to 100%.

We strongly encourage car wash operators to consider cost segregation analysis as part of their strategic tax planning. To get started, you can reach out to us for a free, non-committal cost segregation analysis. Our team of experts will be delighted to guide you through the process and answer any questions you might have.

The benefits of cost segregation for car washes are clear, providing a pathway to impressive tax savings for car washes. Don't let these potential savings slip through your fingers. If you are a car wash operator and want to explore how much you could potentially save on taxes, the time to act is now.