Cost Segregation Company in Phoenix, Arizona

Cost segregation in Phoenix is the premier capital recovery strategy for investors operating in the Valley of the Sun’s high-growth market. As Phoenix continues to lead the nation in industrial expansion and multifamily demand, the need for a sophisticated Phoenix cost segregation provider has reached a critical point. At Engineered Tax Services, we combine deep engineering expertise with the latest tax legislation to turn your building components into immediate, re-investable cash.

A cost segregation analysis is a strategic tax planning tool that enhances your immediate cash flow by postponing tax payments. By conducting a cost segregation study in Phoenix, you could potentially deduct up to 30-35% of your property's initial acquisition cost in the first year!

This is possible because depreciation reflects the declining value of a building as it ages. In reality, your building consists of multiple individual elements (like lighting systems, HVAC units, etc.), each of which degrades over time.

However, these elements are categorized differently from the entire building, which is typically depreciated over 27.5 or 39 years. Individual components are often allocated shorter depreciation periods of either five or 15 years. This accelerates the depreciation benefits, particularly in the early years. No matter if your real estate property in Phoenix is for residential or commercial use, you have the flexibility to spread out this expense over a period of 27.5 or 39 years.

Phoenix Cost Segregation

Real estate owners in Arizona are navigating a unique fiscal landscape. Two primary factors have increased the ROI of cost segregation:

1. The 100% Bonus Depreciation Reinstatement

The federal One Big Beautiful Bill Act (OBBBA), signed in mid-2025, has permanently restored 100% bonus depreciation for assets placed in service after January 19, 2025. This allows Phoenix property owners to deduct the entire cost of 5, 7, and 15-year assets in the very first year, effectively bypassing the previous phase-down.

2. Elimination of Arizona Residential Rental TPT

Arizona has officially eliminated the city-level Transaction Privilege Tax (TPT) on residential rental income. This regulatory shift, combined with a Phoenix cost segregation study, provides a “double-win” for multifamily and single-family rental (SFR) investors by reducing both operational overhead and income tax liability.

Specialized Asset Identification for Phoenix

A top-tier cost segregation company in Phoenix, Arizona, must understand the specific infrastructure required for the desert climate. Engineered Tax Services identifies specialized assets that generic firms often overlook:

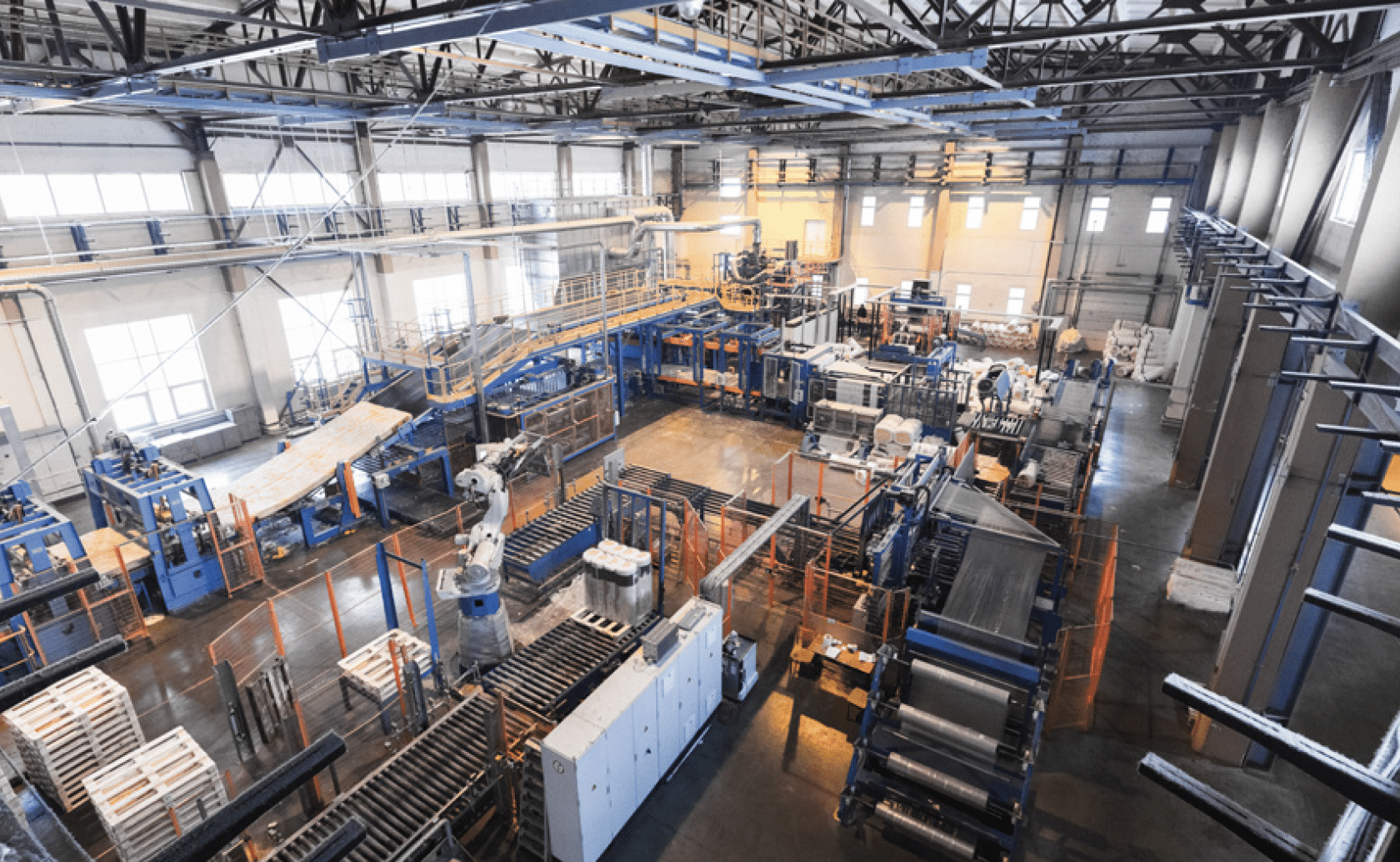

Advanced Manufacturing & Logistics: With over 11 million square feet of industrial space in the Phoenix pipeline, we specialize in reclassifying heavy power systems, specialized cooling for “clean rooms,” and reinforced foundations as 5-year personal property.

Energy-Efficient HVAC Systems: Given Phoenix's extreme heat, HVAC systems are massive capital expenditures. We help you combine cost segregation with Section 179D deductions (now up to $5.00+ per sq. ft. in 2025) for high-efficiency cooling and building envelopes.

Multifamily & Resort Amenities: For luxury developments in Scottsdale and Paradise Valley, we isolate 15-year land improvements—such as pool complexes, specialized desert landscaping, and shaded parking structures—to maximize year-one write-offs.

Why Engineered Tax Services (ETS) is the Leading Phoenix Choice

In a market filled with “automated” tools, Engineered Tax Services provides the engineering rigor required to withstand IRS scrutiny.

CCSP-Certified Engineers: Every study is led by a Certified Cost Segregation Professional, the highest credential in the industry.

Audit-Ready Documentation: Our reports follow the 2025 IRS Audit Technique Guide, ensuring your deductions are defensible.

Local Presence: We understand the nuances of the Maricopa County tax environment and the specific needs of Arizona investors.

Maximize your depreciation benefits!

Explore your property's potential with our cost segregation services in Phoenix. Contact ETS today for a detailed analysis.

Frequently Asked Questions

How Much Depreciation Can Be Accelerated for Your Owned or Leased Property in Phoenix?

Can cost segregation be applied to Phoenix properties purchased years ago?

Yes. Through a “Look-Back Study,” Engineered Tax Services can capture missed depreciation from properties acquired as far back as 1987. We use IRS Form 3115 to claim these “catch-up” deductions on your 2025 return, which is especially beneficial now that the Arizona TPT on residential rentals has been eliminated.

Is cost segregation recommended for smaller residential rentals in Phoenix?

While it is most common for commercial assets, many “high-income” W-2 earners use cost segregation on Short-Term Rentals (STRs) in Scottsdale or Tempe to offset their active income. Engineered Tax Services recommends a feasibility study for any property with a depreciable basis of $500,000 or more to ensure the tax savings outweigh the engineering fees.

Contact Us Today

Phoenix

(800) 236-6519

Get Your Questions Answered about Cost Segregation!

Our Cost Segregation Specialists are happy to answer your questions about this federal income tax tool.

Webinars:

Possibilities: How to navigate economic uncertainty as a real estate investor

Webinar covering Cost Segregation, Bonus Depreciation, energy-efficient tax credits and more.