The Historic Preservation Tax Incentives Program, jointly administered by the National Park Service and the State Historic Preservation Offices, is the nation’s most effective Federal program to promote urban and rural revitalization and to encourage private investment in rehabilitating historic buildings. These tax incentives apply explicitly to preserving income-producing historic property and have generated billions of dollars in historic and rehabilitation preservation activity since the program’s commencement in 1976.

There are two categories of preservation tax credits as outlined below:

- Pursuant to I.R.C. § 47(a)(1), the Rehabilitation Tax Credit offers a 10 percent credit available for the rehabilitation of non-historic buildings with an additional requirement that the building must have been originally constructed before 1936; or

- Pursuant to I.R.C. § 47(a)(2), the Historic Tax Credit offers a 20 percent credit available for the rehabilitation of a Certified Historic Structure (e.g., one listed on the National Register of Historic Places or located in a Registered Historic District and determined to be of significance to the Historical District).

These preservation tax incentives can significantly reduce a property owner’s perceived costs for the renovation of an older building and should certainly be considered when planning a renovation project. In addition, it should be duly noted that most states now offer preservation based tax incentives at the state level (e.g., such as ME, NH, VT, MA, RI, CT, NY, PA, DE, MD, WV, VA, NC, SC, GA, FL, MS, LA, AR, MO, IA, MN, WI, IN, KY, MI, OH, ND, KS, OK, CO, NM, UT & MT with several remaining states introducing legislation that would create a similar program in NJ, AL, IL, and TX) which can be utilized in conjunction with the federal-level incentives to further reduce the expenditures of a property owner’s renovation.

Please contact Engineered Tax Services today for a complimentary consultation to see if you qualify for this advantageous incentive.

About the Author

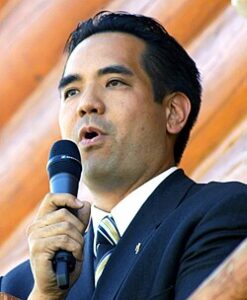

Peter J. Scalise serves as the National Partner-in-Charge and the Federal Tax Practice Leader for Engineered Tax Services. Peter is also a highly distinguished BIG 4 Alumni Tax Practice Leader. Peter is a member of both the Board of Directors and Board of Editors for The American Society of Tax Professionals (ASTP) and is the Founding President and Chairman of The Northeastern Region Tax Roundtable, an Operating Division of ASTP. Peter is a volunteer member of the iShade Tax Faculty and a frequent keynote speaker for the AICPA, ABA, NAREIT, ASTP, NATP, TEI & AIA on specialty tax incentives and legislative updates from Capitol Hill.

ETS Disclaimer

The article is designed to provide authoritative information on the subject matter covered. However, it is distributed with the understanding that the publisher, editors, and authors are not engaged in rendering legal, accounting, or other related professional services for your client base. Consequently, it is your responsibility to exercise all of the necessary measures to ensure proper tax preparation and tax advisory services for your client base.

Circular 230 Disclaimer

Circular 230 Notice: In compliance with U.S. Treasury Regulations, the information included herein (or in any attachment) is not intended or written to be used, and it cannot be used, by any taxpayer for the purpose of i) avoiding penalties the IRS and others may impose on the taxpayer or ii) promoting, marketing, or recommending to another party any tax related matters.