Case Study: Cost Segregation Analysis for a Short-Term Rental Property in Encinitas, California

Narrative In 2024, the owners of a two-story residential property in Encinitas, California, undertook strategic

Welcome to our extensive collection of cost segregation case studies and examples at Engineered Tax Services. We specialize in helping businesses across various industries maximize their potential for cost segregation. Our team of experts understands the unique components of different property types, and we work closely with our clients to ensure they accurately depreciate all building components.

Our real-world case studies and cost segregation study examples highlight the significant benefits of this strategy across various property types, including apartment complexes, manufacturing facilities, warehouses, shopping malls, office buildings, auto shops, restaurants, and more. Each case study and example provides a detailed look at how cost segregation can be applied to a specific property type, emphasizing the potential tax savings and financial advantages.

Whether you are a property owner, a tax professional, or someone interested in learning more about cost segregation, our case studies and examples offer valuable insights into the process and benefits. By reviewing these detailed accounts, you will gain a clear understanding of how cost segregation can contribute to maximizing tax savings and improving your financial outcomes.

For personalized assistance and to learn more about how cost segregation can benefit your property, contact us today. Our experts are ready to help you navigate the complexities and achieve the maximum potential for tax savings.

Narrative In 2024, the owners of a two-story residential property in Encinitas, California, undertook strategic

Narrative In 2024, the owners of a residential condominium in Hilton Head Island, South Carolina,

Narrative In 2023, a cost segregation study was performed on an apartment complex in Ennis,

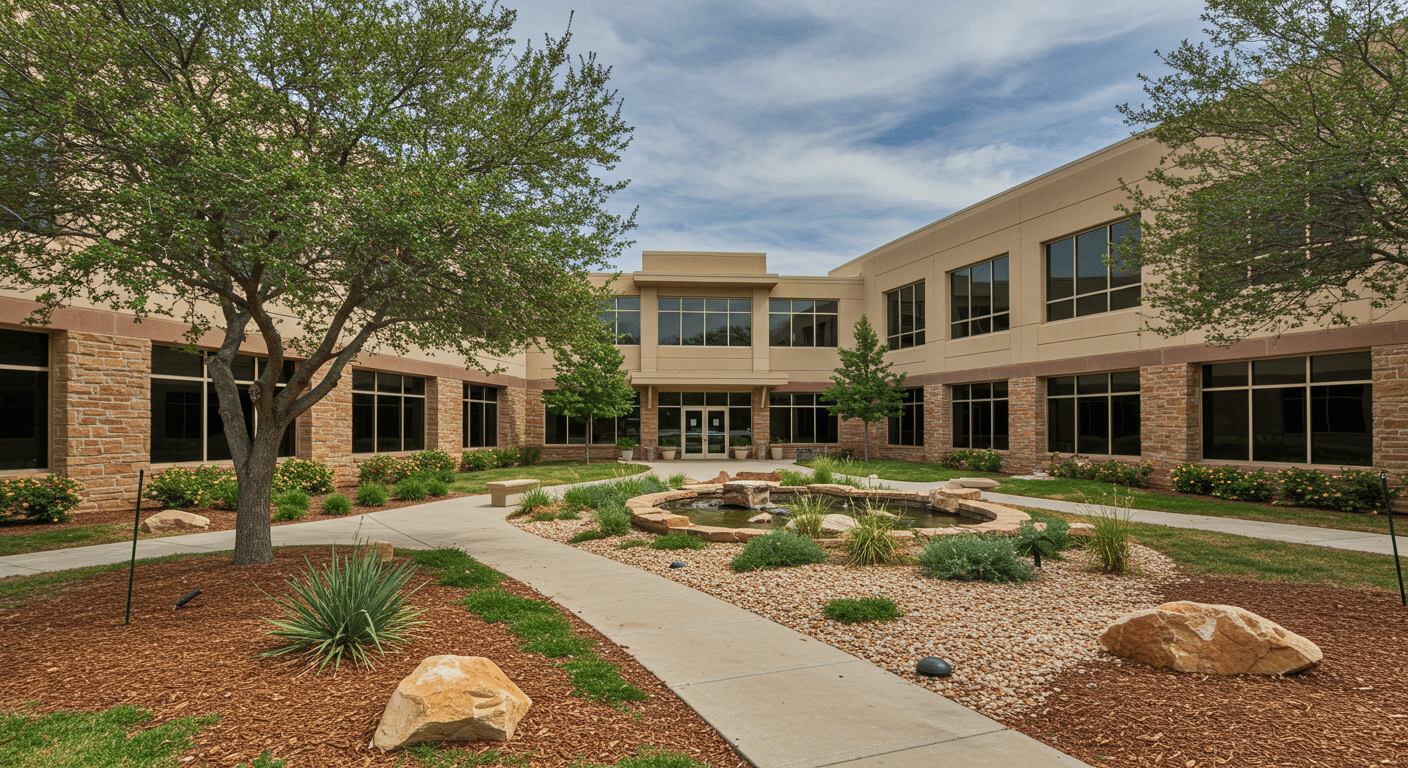

Narrative In July 2024, the owners of a medical-dental office building in Cheyenne, Wyoming undertook

Narrative In 2023, the owners of a short-term rental property in Indio, California, undertook strategic

Narrative In 2024, the owners of a residential condominium unit in Margate, New Jersey, undertook

Narrative In 2024, the owners of a fast-food restaurant in Dayton, Texas undertook strategic tax

Narrative In 2022, the owners of a medical office building in Bradenton, Florida, undertook strategic

Narrative In 2024, the owners of a medical office building in Broken Arrow, Oklahoma, sought

Narrative In 2024, a cost segregation study was performed on a standalone retail building in