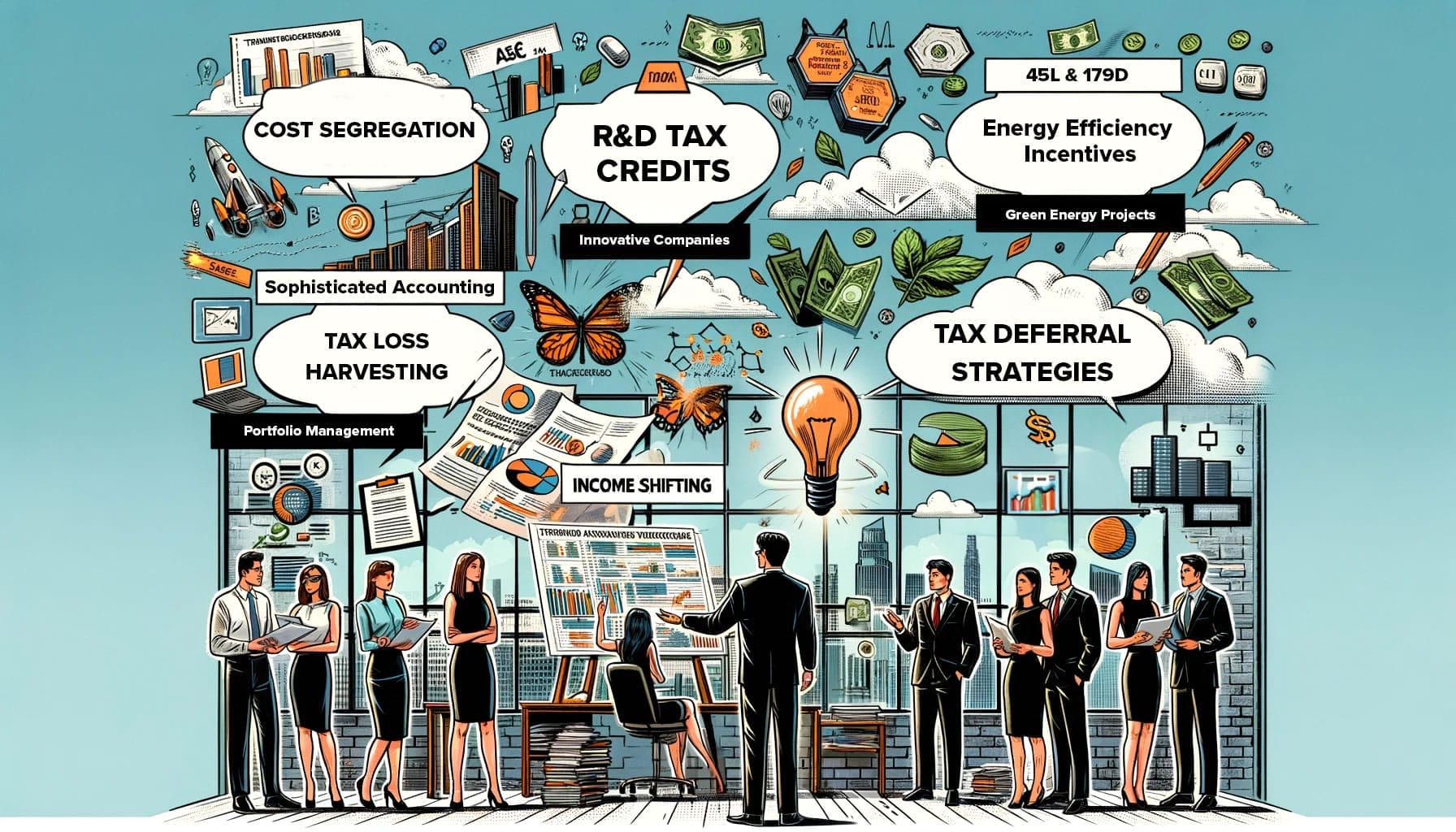

How Advanced Accounting Techniques Can Optimize Your Tax Benefits

When it comes to financial planning, minimizing taxes is key. As Benjamin Franklin famously quipped, “nothing can be said to be certain except death and taxes.” While death awaits us all, strategic tax planning allows us to hold onto more of our hard-earned money. This blog post explores advanced accounting techniques that transform tax compliance