Case Studies: Manufacturing

View cost segregation case studies for custom manufacturers, manufacturing facilities, and food manufacturers. Here you’ll find several case study examples regarding research and development tax incentives and disposition studies for manufacturing plants.

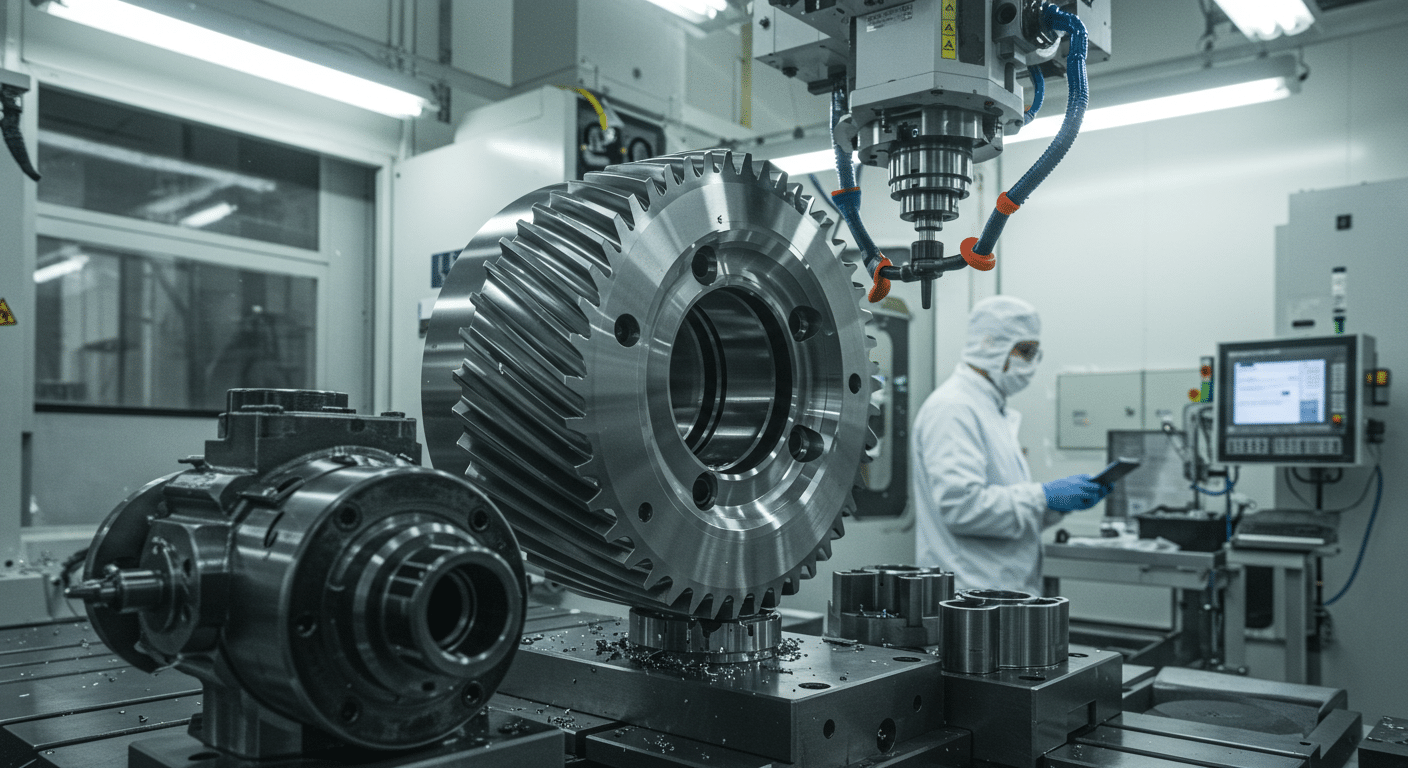

R&D Case Study on a Custom Manufacturer in New York

1 Year Tax Savings: $689,289.00 Engineered Tax Services helped this custom manufacturer in New York claim research and development tax credits. Our engineers uncovered $6,696,996 in qualified expenditures to provide … Read more

Cost Segregation Study For A $2.2 Million Manufacturer San Diego, California

$368,837.70 in first-year tax savings This San Diego, California manufacturer was purchased for $2.2 million in 2021. Taking the straight-line depreciation value, it would have generated approximately $56,400 of depreciation … Read more

Cost Segregation Study For Industrial Property In Grovetown, Georgia

$395,121.65 in first year tax savings This $1.5 million industrial property was purchased in Grovetown, Georgia in 2021. Taking the straight-line depreciation value, it would have generated a first-year depreciation … Read more

Disposition Study For A Wood Manufacturing Facility In Louisiana

Engineered Tax Services determined and identified the unit of property cost basis for improvements made to these two manufacturing facilities in Chopin and Oakdale, LA. By assigning value to lighting … Read more

Cost Segregation and 179D Energy Tax Credits for Manufacturers

By applying cost segregation, property investors accelerate depreciation, reduce tax liability and increase their bottom line. This aids in future benefits via abandonment, repairs, routine maintenance and overall asset management. ETS performs … Read more

179D Energy Study for a Manufacturing Facility in Princeton, MN

Location Improvement % Contribution Tax Benefit Princeton, MN – 30,280 sq. ft. $54,504 Lighting %31.38 Envelope %8.07 HVAC %10.68 Total Building Cost $54,504 This manufacturing building, completed in September 2010, … Read more