Case Study: Cost Segregation Analysis for a Residential House in Stuart, FL

Narrative In 2021, the owners of a residential house in Stuart, FL, undertook strategic tax

Welcome to our collection of case studies focused on residential property tax savings. At Engineered Tax Services, we specialize in helping homeowners and property investors navigate the complexities of the tax system, particularly in the realm of residential properties. Our expertise spans across various tax strategies, including cost segregation and energy tax deductions, all aimed at maximizing your tax savings.

Residential properties present unique opportunities for tax savings. Whether you’re a homeowner or a property investor, understanding these opportunities can significantly impact your financial outcomes. Our case studies serve as a comprehensive resource, providing insights into the various tax strategies applicable to residential properties.

Our team of specialty tax consultants has a wealth of experience in dealing with a diverse range of residential properties. From single-family homes to multi-family apartment buildings, we’ve helped numerous clients leverage tax strategies to their advantage. Our case studies reflect this breadth of experience, offering a glimpse into our approach and the results we’ve achieved.

Narrative In 2021, the owners of a residential house in Stuart, FL, undertook strategic tax

Narrative In 2020, the owners of a residential property in Charlotte, North Carolina, undertook strategic

Narrative In 2016, the owners of a short-term rental property in Kissimmee, Florida, undertook strategic

Narrative In 2024, the owner of a residential property in West Palm Beach, Florida, undertook

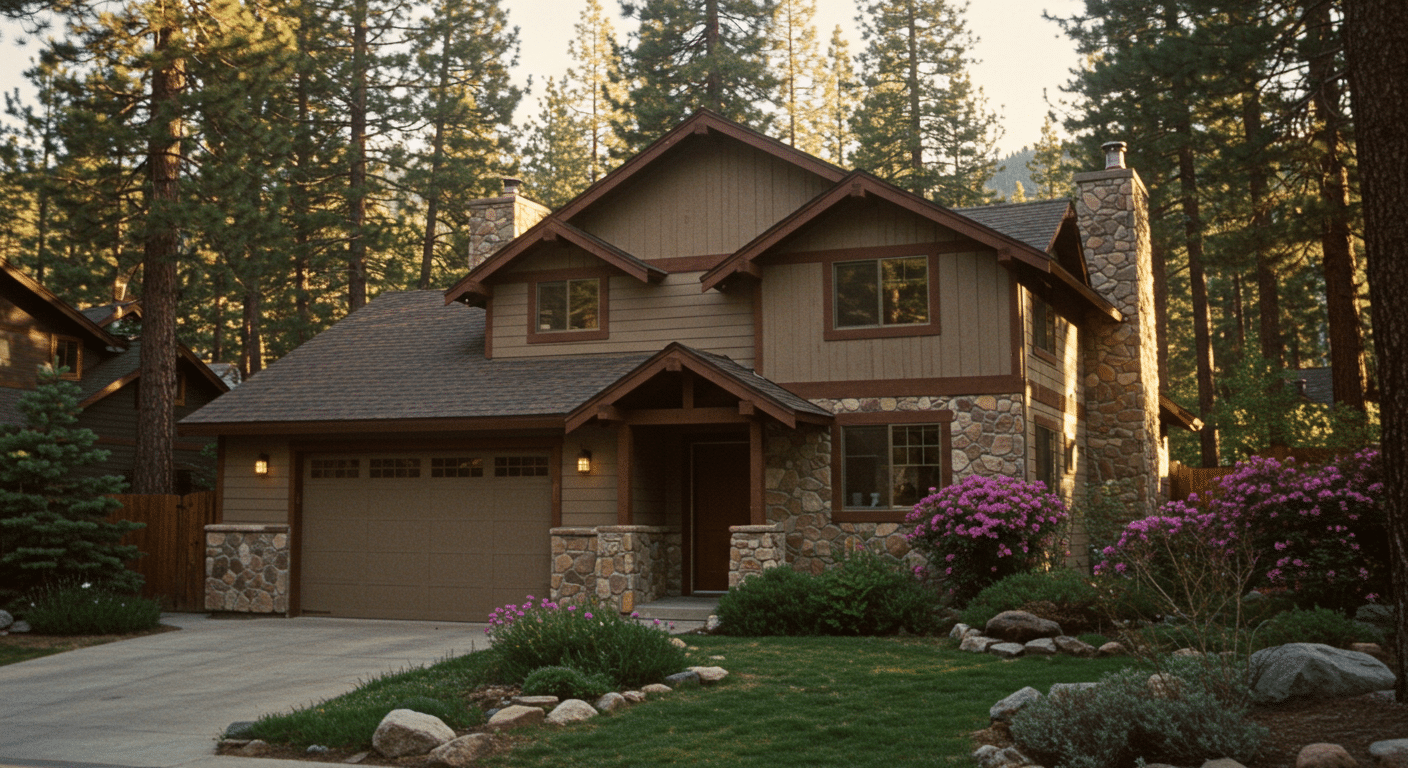

Narrative In 2024, the owners of a two-story residential property in Tahoe Vista, California engaged

Narrative In 2024, the owners of a three-story residential property in Hilton Head Island, South

Narrative In 2024, the owner of a condominium in Nashville, TN, undertook a strategic tax

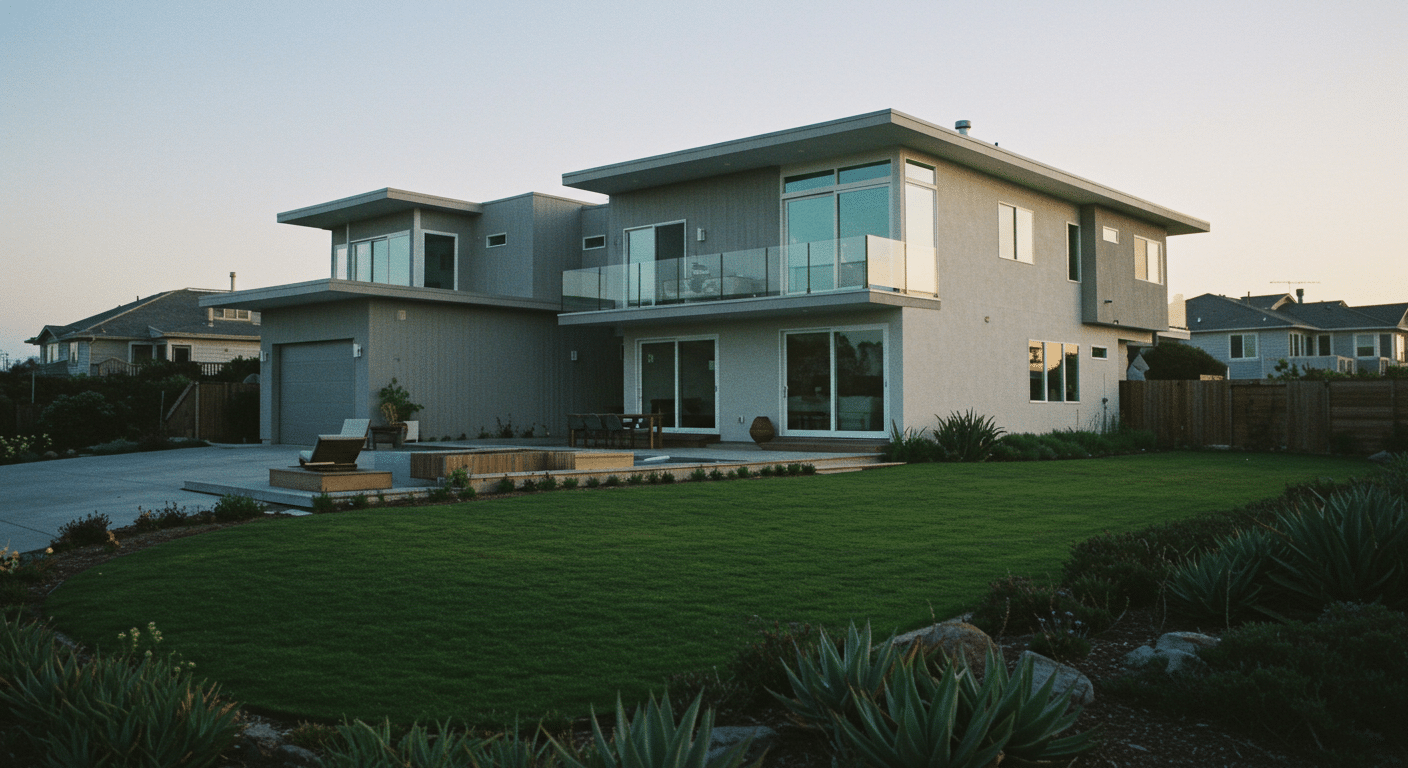

Narrative In 2024, the owners of a two-story residential property in Encinitas, California, undertook strategic

Narrative In 2024, the owners of a residential condominium in Hilton Head Island, South Carolina,

Narrative In 2024, the owners of a residential condominium unit in Margate, New Jersey, undertook