179D Benefit and Cost Segregation for an Auto Dealership in Omaha Nebraska

$756,076.76 in Additional Tax Savings The owner of this auto dealership in Omaha, Nebraska initially hired a different company to

Welcome to our comprehensive collection of 179D tax deduction case studies. At Engineered Tax Services, we are committed to helping businesses unlock the potential of energy-efficient tax deductions under IRC Section 179D. Our case studies showcase a wide range of commercial properties, including auto dealerships, parking garages, architectural firms, public schools, hotels, shopping centers and more, that have successfully claimed 179D tax deductions.

The 179D tax deduction is a powerful tool for businesses to reduce their tax liability while promoting energy efficiency. It rewards businesses that invest in energy-saving improvements to their commercial properties. Our case studies provide real-world examples of how businesses have leveraged this tax incentive to achieve significant tax savings.

Whether you’re a business owner, a tax professional or someone keen on understanding the nuances of 179D tax deductions, our case studies offer a wealth of insights. Each case study delves into the application of the 179D tax deduction in a specific business scenario to illustrate how tax savings can be achieved.

$756,076.76 in Additional Tax Savings The owner of this auto dealership in Omaha, Nebraska initially hired a different company to

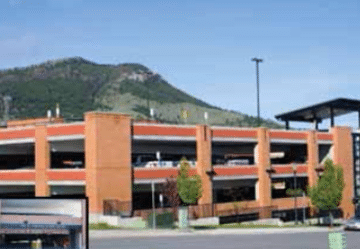

This parking garage owner hired Engineered Tax Services to conduct energy evaluations for parking garages in Arizona, Montana, California, New

$154,945.20 in Total Realized Tax Savings This parking garage in Davie, FL utilizes automatic lighting features for qualified parking areas.

This architectural firm partnered with Engineered Tax Services to prepare EPAct certifications for various public buildings they designed. Because the

Engineered Tax Services conducted 179D energy evaluations for seven high schools in Texas, Indiana, California, South Carolina and Alabama. As

This public school designer worked on two elementary schools in Delray and West Palm Beach, Florida. Because they designed the

Having worked on numerous schools and office buildings, this architecture firm was experienced with energy-efficient design and construction techniques. To

This designer was hired to work on an energy-efficient building in Temecula, CA. Upon completion of the building, Engineered Tax

Engineered Tax Services conducted 179D energy evaluations for two military buildings in Baton Rouge, LA. Having certified both buildings as

These three National Guard buildings in Johnston, IA were constructed using energy-efficient materials and techniques. As a result, they qualified

Find services, resources, case studies, and more

Esc to close